TOP Ultimate Breakout

with Multiple Exit Hedge Fund Technology

Easy-To-Use super indicator! You can now get advanced hedge fund caliber breakout trading technology developed for both new and professional traders! The TOP Ultimate Breakout strategy can be used to trade Stocks, Options, Futures, Forex, ETFs, and CFDs. Applications for Day Trading, Swing Trading, and Trend Trading.

Designed after an actual Hedge Fund breakout strategy that we used to manage millions of dollars of real money in the markets. The predecessor to the TOP Ultimate Breakout strategy helped us win Hedge Fund Star Search honors. In fact, the TOP Ultimate Breakout strategy could be one of the most powerful breakout strategies available!

Modeled after actual Hedge Fund Breakout Strategy

Our hedge fund researched many different types of trading strategies. Our goal was to develop the most effective strategies to manage our multi-million dollar portfolio. We selected a core set of back-tested trading strategies to manage millions of dollars of real client funds, and one of our core strategies was based on the Breakout Trading System. Our core strategies enabled us to earn the honor of Top New (CTA) Hedge Fund Manager Class with Futures Magazine, where our hedge fund was featured as one of four top hedge fund managers for the year out of a pool of over 30 international hedge fund managers.

Our trading advantage involved developing the most robust trading strategies that could have the ability to trade many different asset classes and, in addition, that could also trade a wide variety of challenging market environments. We discovered that an optimized breakout strategy was could be highly effective in trading markets that were experiencing good directional volatility or trending characteristics.

We have worked hard to make a good thing better! We have made powerful enhancements to our original core breakout trading strategy concept by incorporating multiple profit target levels along with our modified trailing stop algorithm. The result is a powerful, easy-to-use breakout trading strategy that can be used to trade many different types of markets.

Trade Stocks, Options, ETFs, Futures, and Forex Markets.

It doesn’t matter what markets you trade, the Ultimate Breakout strategy is designed to trade multiple asset classes including Stocks, Options, ETFs, Futures, and FOREX markets. In fact, the broad application potential of our hedge fund breakout strategy helped us win Top New (CTA) Hedge Fund Managers Class in Futures Magazine.

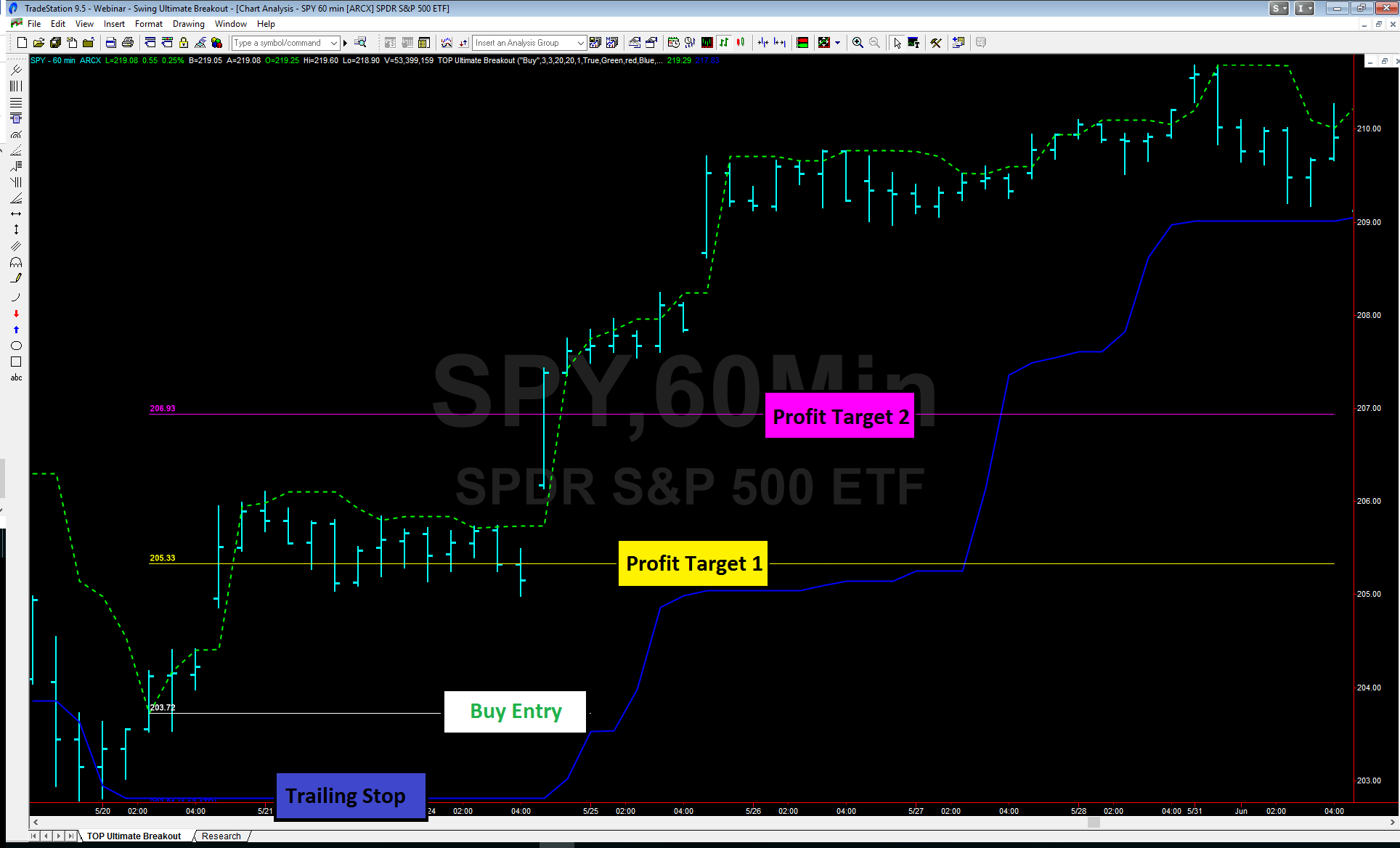

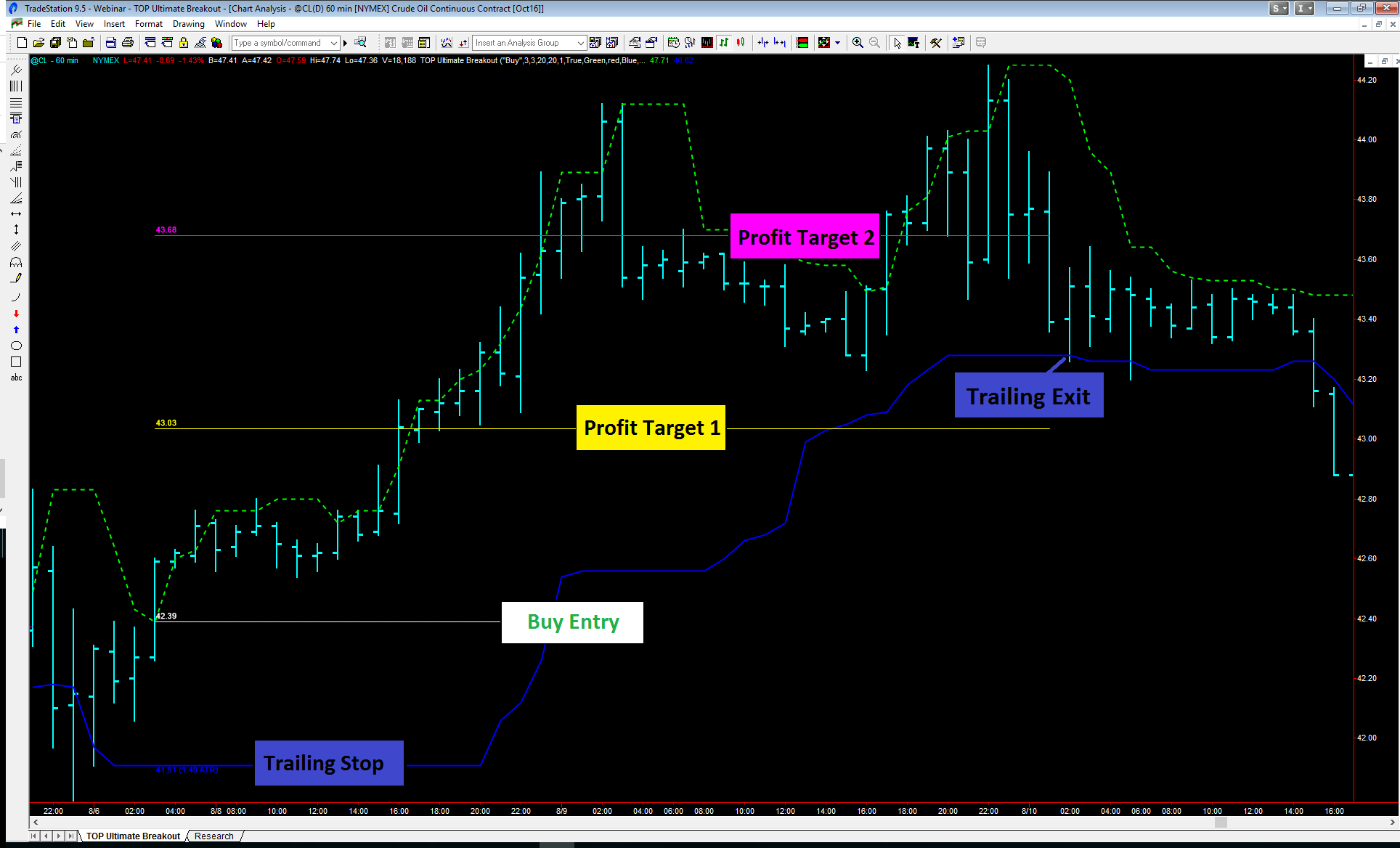

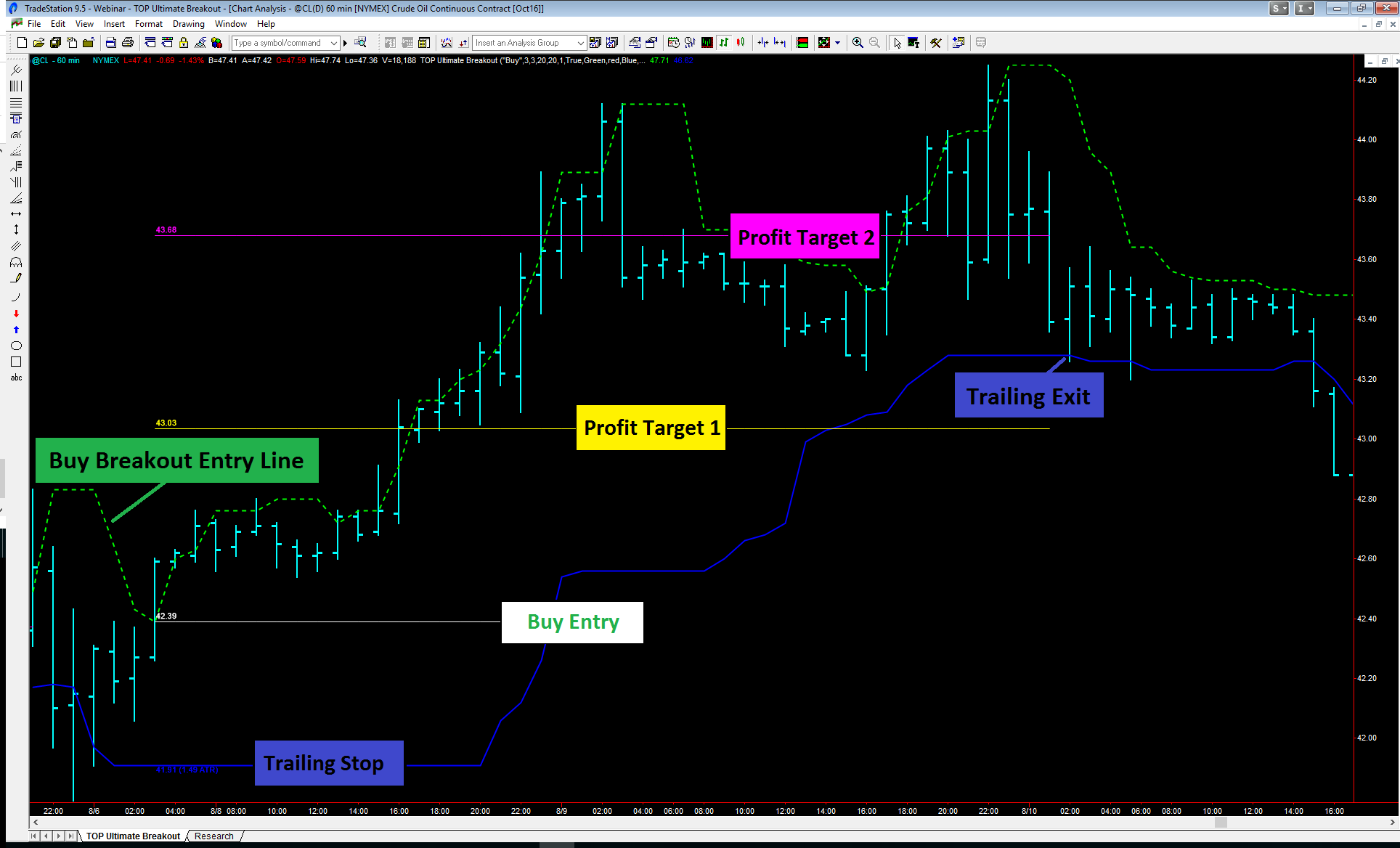

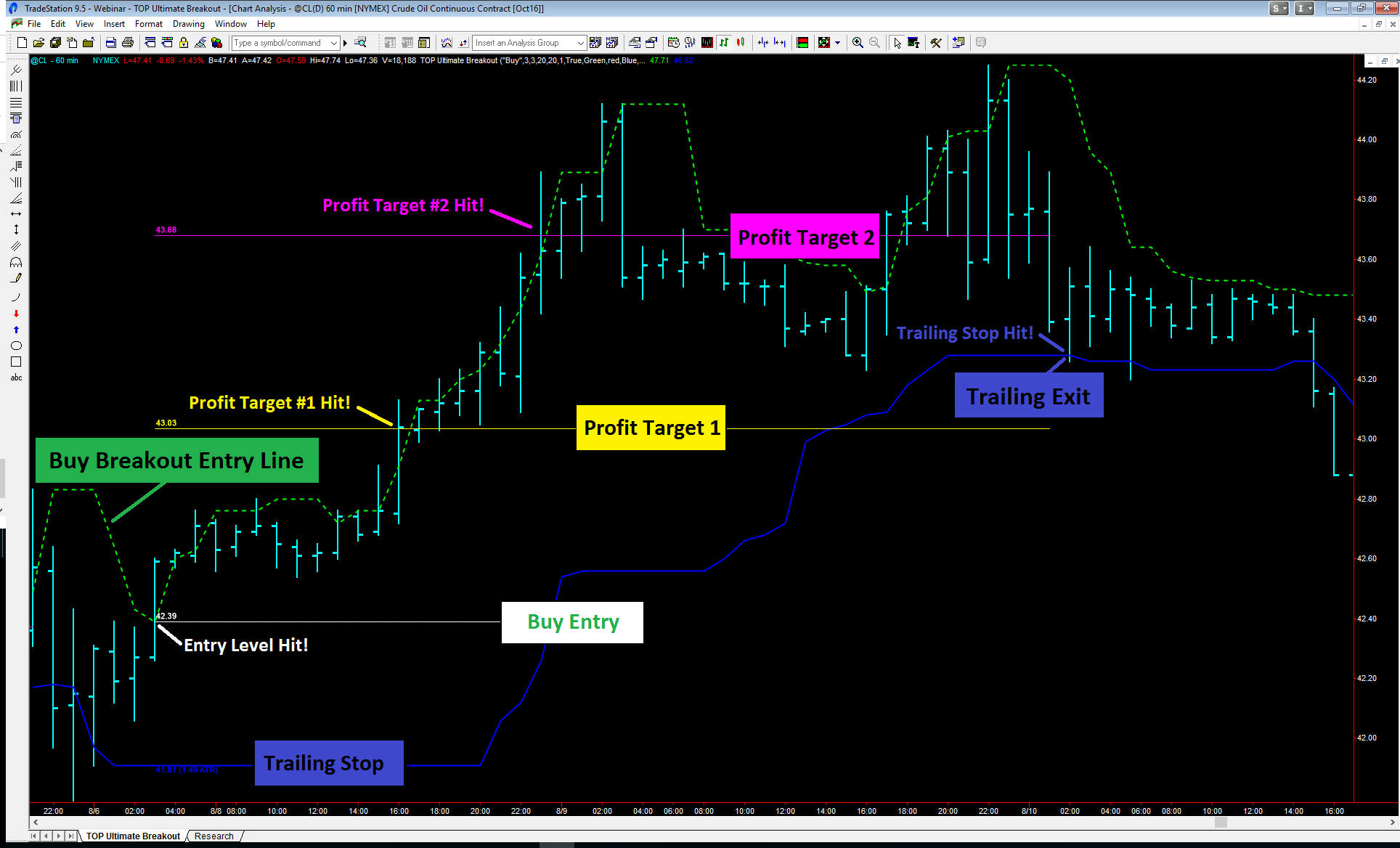

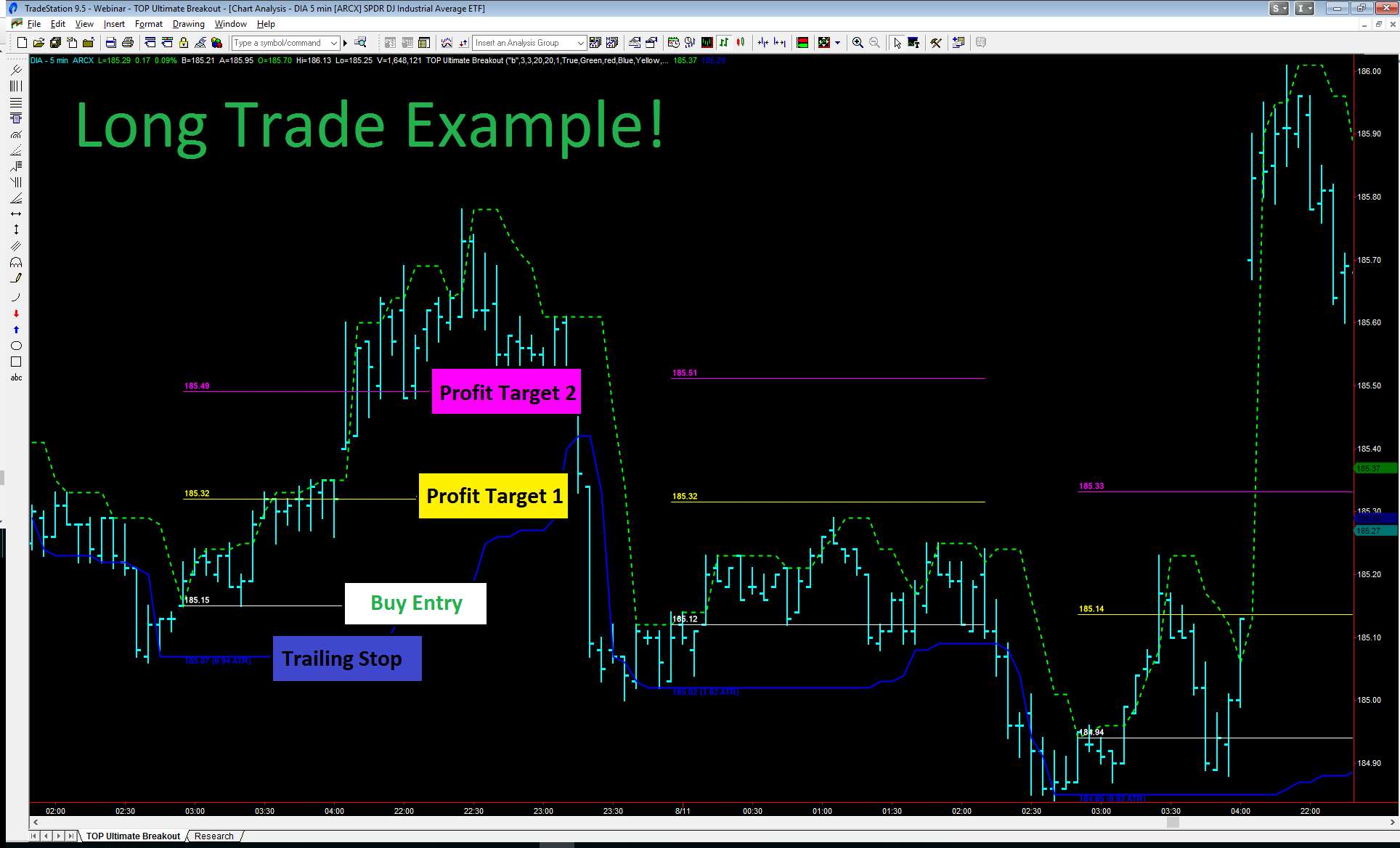

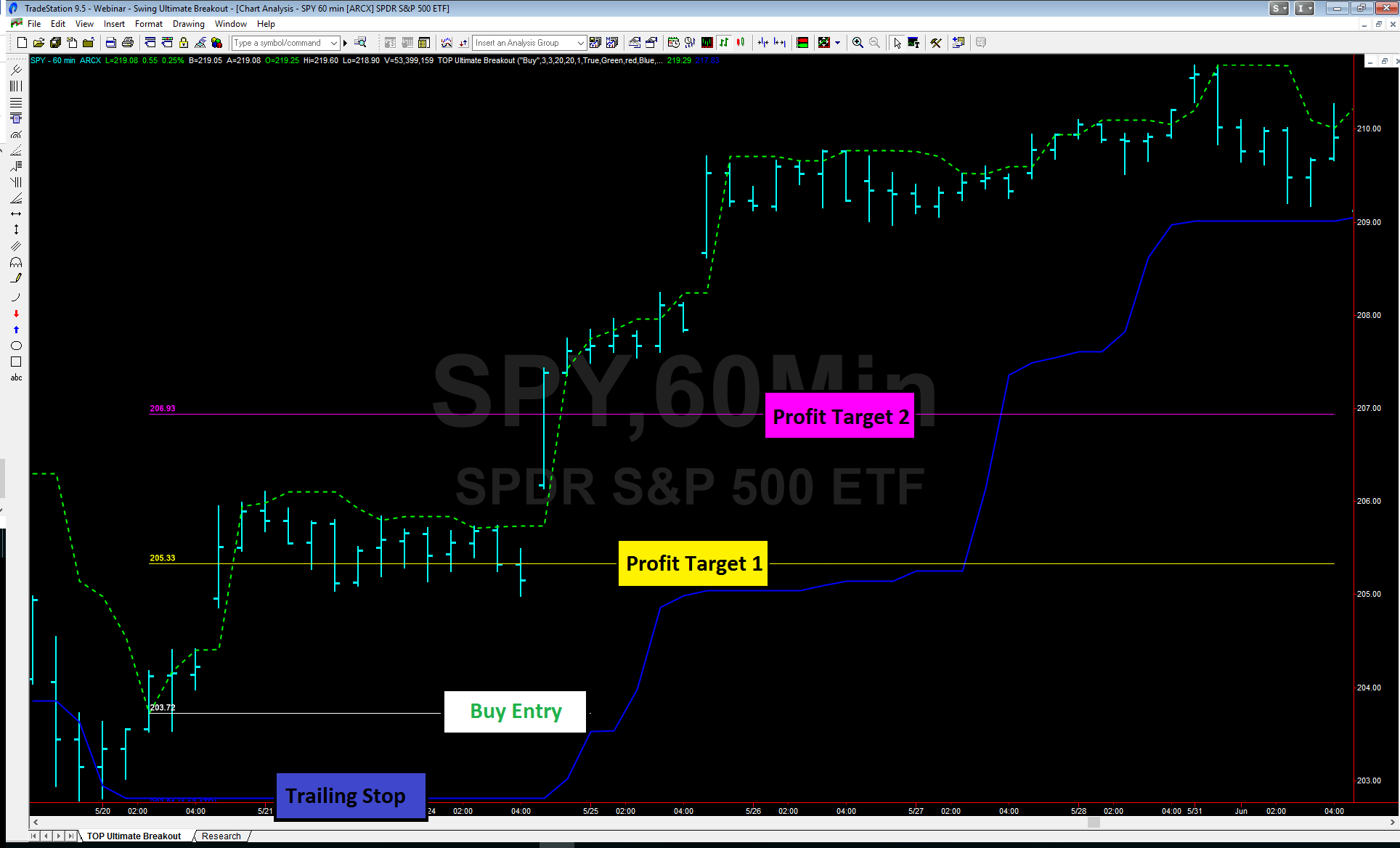

The TOP Ultimate Breakout strategy makes it easy to identify real-time Buy and Sell breakout signals in any market you trade right on your charting window. With clearly defined breakout entry and profit target exit levels, there is no confusion about where to enter or exit your trades. The labels displayed on the chart above highlight the breakout and profit target lines in the TOP Ultimate Breakout strategy.

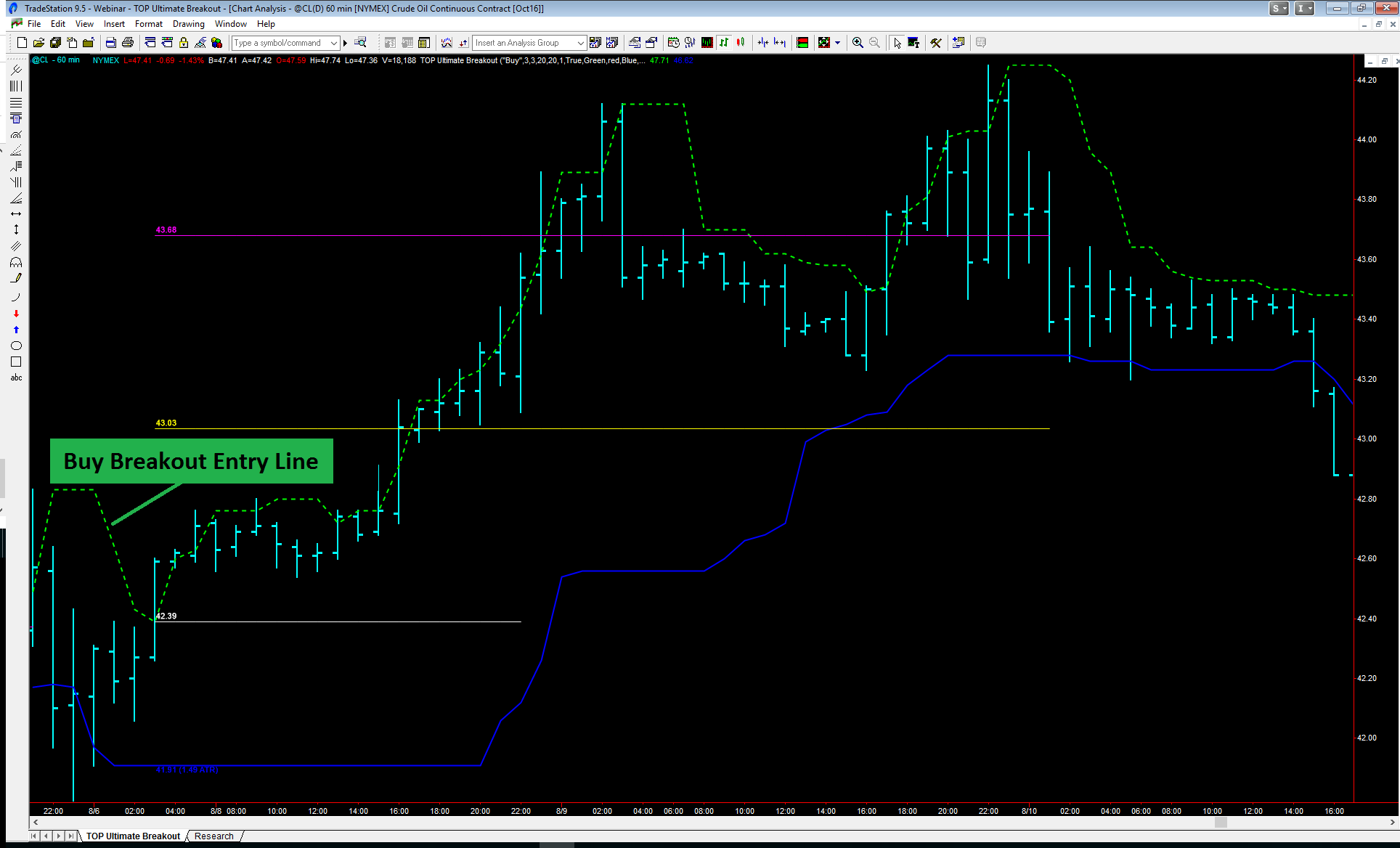

Trading the TOP Ultimate Breakout is easy! Here is how it works. If you identify a bullish trade setup and are looking to buy in a market, you would place your Buy Entry Stop at the level of the Dashed Green Line in the chart below.

When this level has been hit by your market, then the TOP Ultimate Breakout strategy will display your Breakout Trading Lines, which include your Entry Line (White), Profit Target #1 line (Yellow), and Profit Target #2 line (Magenta Line).

Once your Buy Entry Stop has been hit and you are long the market, then you should consider placing your Risk Management Stop below the solid blue Trailing Stop line (see chart above).

Breakout Buy Signal (Green Dashed) and Risk Trailing Stop (Solid Blue) Lines

-

Dashed Green Line (Buy Stop Entry Level)

-

Solid Blue Line (Risk Trailing Stop Exit)

Once you are long a market after your Buy Entry Stop is hit, then the TOP Ultimate Breakout trade lines are displayed to make it easy for you to either exit at Profit Targets or exit at your Trailing Stop line:

-

White Line is displayed at Buy or Sell Entry Level

-

Yellow Line is displayed at Profit Target #1

-

Magenta Line is displayed at Profit Target #2

-

Solid Blue Line is displayed at Trailing Risk Stop Level

Remove the Guesswork with Ultimate Breakout

Professional traders will tell you that successful trading involves consistently applying a proven trading strategy to the markets over time. Most traders who lose money are relying on their emotions and discretion to determine where to Buy and Sell in markets. With the TOP Ultimate Breakout Strategy, you have a powerful approach removes the guesswork from trading and shows you exactly where to Buy, Sell, and Exit your trades. It doesn’t get any better than that!

Day Trade, Swing Trade, or Trend Trades with Ultimate Breakout

There are not many trading strategies that you can use to Day Trade, Swing Trade, and Trend Trade. However, the TOP Ultimate Breakout strategy can be highly effective at achieving profits with all of these types of trading. It is important to note, however, that there is a risk of loss when trading in the markets.

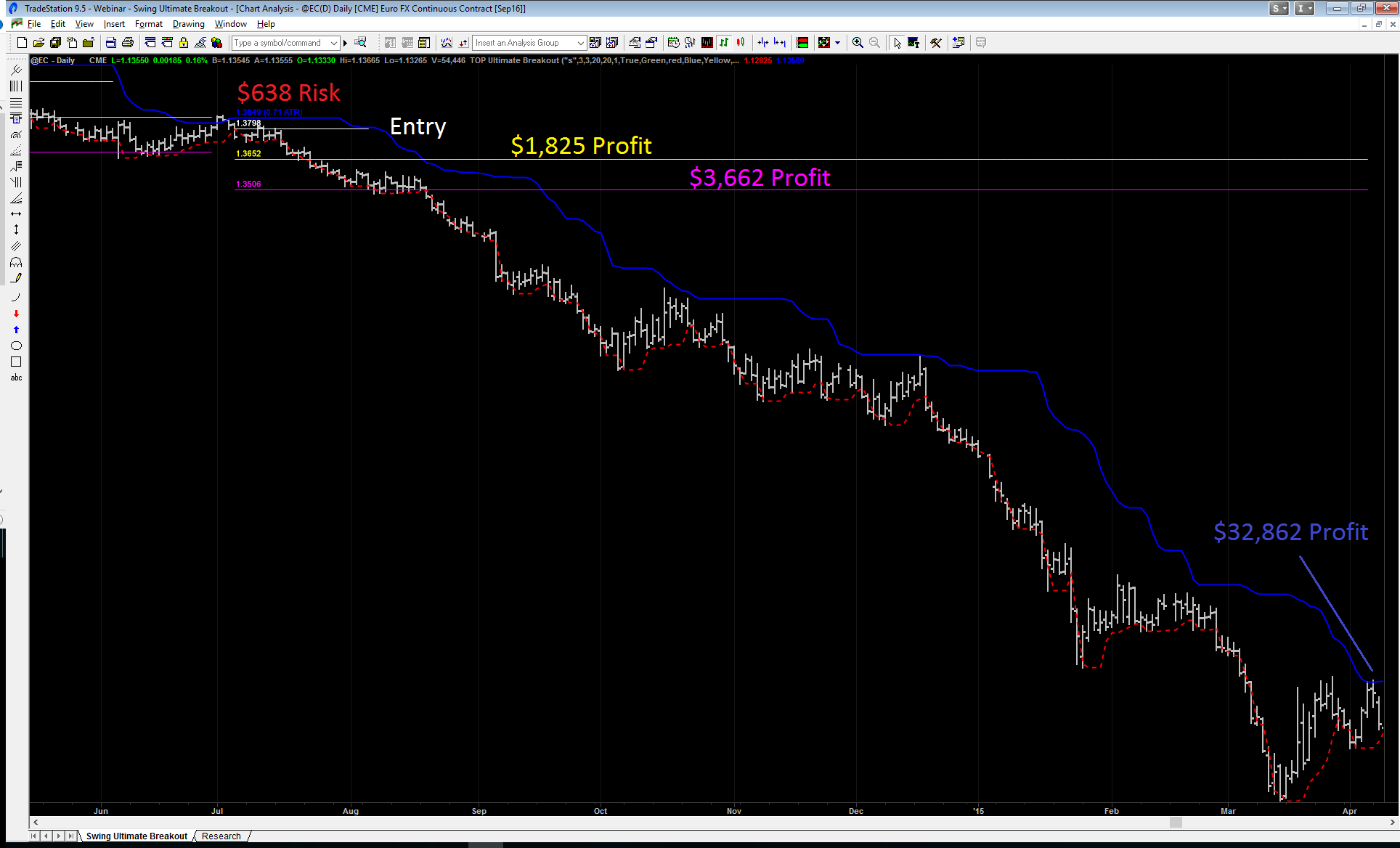

Euro Currency Trend Trade Example

When the Euro currency began to fall sharply against the US Dollar, the TOP Ultimate Breakout strategy was effective in identifying an excellent Sell Signal and was effective in capturing profits from the down trend with the Trailing Stop (see chart below).

Referencing the Euro Currency Short trade example in the chart above, you can see that for one contract you could have made $1,825 in profit by exiting at Profit Target #1, or you could have made $3,662 in profit by exiting at Profit Target #2, or you could have made $32,862 in profit by exiting at the Trailing Stop level.

The TOP Ultimate Breakout makes it easy for you to not only see where to get into markets, but this powerful strategy also makes it easy for you to see where to exit markets as well. The above Euro currency example demonstrates the ability of the TOP Ultimate Breakout to capture profits quickly or, in cases of very strong trending markets, capture profits from trending price moves as well (by exiting at the Trailing Stop).

In this case, the Trailing Stop would have been effective in profiting from the longer-term down trend move. By giving you three different exit opportunities, the TOP Ultimate Breakout offers flexibility for all types of trading, including day trading, swing trading, and trend trading. By changing the bar interval timeframe on your chart, you can focus on shorter-term or longer-term trades.

Be sure to read the hypothetical risk disclaimer at the bottom of this webpage. It goes without saying that when trading in the markets, there is both a potential to profit and a risk of loss.

Ability to Profit from Selling Short

The TOP Ultimate Breakout not only has the ability to profit from long trades, but the TOP Ultimate Breakout also has the potential to profit from short trades as well by entering Sell signals at the Sell Entry Breakout level like the Euro currency example above.

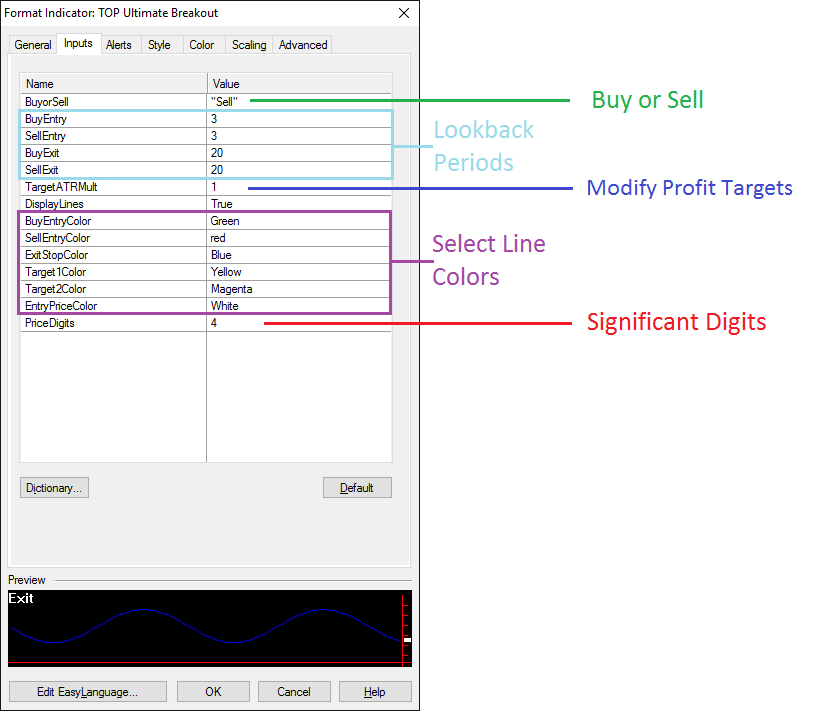

Easy and Flexible Parameter Settings

Some trading strategies require you to learn complex parameter settings before you can effectively use the trading strategy. Not with TOP Ultimate Breakout. We have designed the TOP Ultimate Breakout to include key parameters to give you the power and flexibility to modify entry and exit lookback periods, modify profit target levels, select line colors, and to even turn off breakout entry and profit target lines if you so desire.

Below is a brief description of each strategy parameter:

BuyorSell – Set the TOP Ultimate Breakout to Buy Mode or Sell Mode by entering the following:

“Buy” or “buy” or “B” or “b” – Sets Ultimate Breakout to Buy Mode

“Sell” or “sell” or “S” or “s” – Sets Ultimate Breakout to Sell Mode

Recommended Default: “Buy” or “Sell”

Possible Values: “Buy” or “buy” or “B” or “b” or “Sell” or “sell” or “S” or “s”

BuyEntry (Buy Mode Only) – This sets the lookback period for your Buy Breakout Entry Signal. If this value is set to 1, then the TOP Ultimate Breakout would enter a Buy or Long position when the market breaks above the high of the previous price bar. If this value is set to 5, then the TOP Ultimate Breakout would enter a Buy or Long position when the market breaks above the highest high for of the previous 5 price bars.

Recommended Default: 3

Recommended Range: 1 – 5

SellEntry (Sell Mode Only) – This sets the lookback period for your Sell Breakout Entry Signal. If this value is set to 1, then the TOP Ultimate Breakout would enter a Sell or Short position when the market breaks below the low of the previous price bar. If this value is set to 5, then the TOP Ultimate Breakout would enter a Sell or Short position when the market breaks below the lowest low for of the previous 5 price bars.

Recommended Default: 3

Recommended Range: 1 – 5

BuyExit (Buy Mode Only) – This sets the lookback period for your Buy Trailing Stop Exit. This works similar to the SellEntry setting in that it references previous bar lows, but it uses a slightly different algorithm designed specifically for the Trailing Stop.

Recommended Default: 20

Recommended Range: 5 – 100

SellEntry (Sell Mode Only – This sets the lookback period for your Sell Trailing Stop Exit. This works similar to the BuyEntry setting in that it references previous bar highs, but it uses a slightly different algorithm designed specifically for the Trailing Stop.

Recommended Default: 20

Recommended Range: 5 – 100

TargetATRMult – This sets the distance between your breakout entry signal and your Profit Targets. The larger the number, the further away your Profit Targets will be from your entry signal line.

Recommended Default: 1

Recommended Range: 0.5 – 3

DisplayLines – Set this to True to display the Entry and Profit Target Lines or False to not display these lines.

Recommended Default: True

Possible Values: True of False

BuyEntryColor – Sets color of the Buy Entry Dashed Line. Set this to any platform color. (Default Green)

SellEntryColor – Sets color of the Sell Entry Dashed Line. Set this to any platform color. (Default Red)

ExitStopColor – Sets color of the Trailing Stop Line. Set this to any platform color. (Default Blue)

Target1Color – Sets color of the Profit Target #1 Line. Set this to any platform color. (Default Yellow)

Target2Color – Sets color of the Profit Target #2 Line. Set this to any platform color. (Default Magenta)

EntryPriceColor – Sets color of the Entry Price Line. Set this to any platform color. (Default White)

Price Digits – Sets the significant digits for the prices displayed next to your lines. (Stocks Default: 2, FOREX Default: 4)

Powerful Trailing Stop Technology

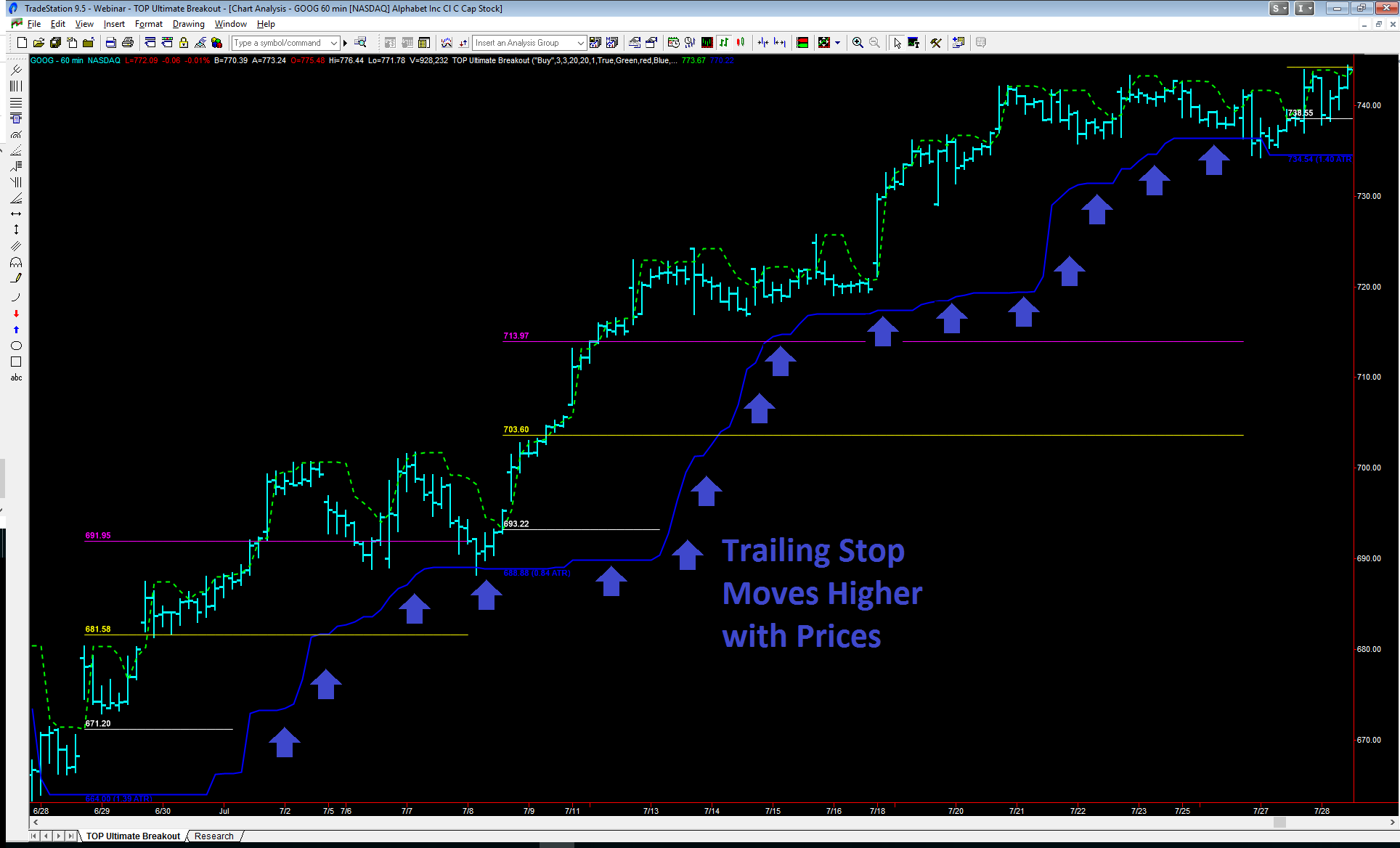

Placing risk stops in the markets is one of the most challenging aspects of trading. The TOP Ultimate Breakout has a powerful Trailing Stop algorithm that is designed to show you where to place your initial Risk Stops and, in addition, is designed to trail the market if prices move in your anticipated direction for profitable trades.

Once the TOP Ultimate Breakout Trailing Stop moves past your entry price level, then you should have a risk free trade if you place your stop above your entry level (assuming that the market does not gap through your stop).

Because professional trading involves limiting losses, the TOP Ultimate Breakout strategy enables you to quickly and easily identify a strategic location to place your Risk Stop. Notice in the chart below that for a Buy or Long position, the Trailing Stop follows price action as the trade becomes profitable. While the Trailing Stop initially acts as a risk management stop, it transforms into a trailing stop and becomes a great tool to lock in profits once prices move above (for long trades) your entry price level or below (for short trades) your entry price level.

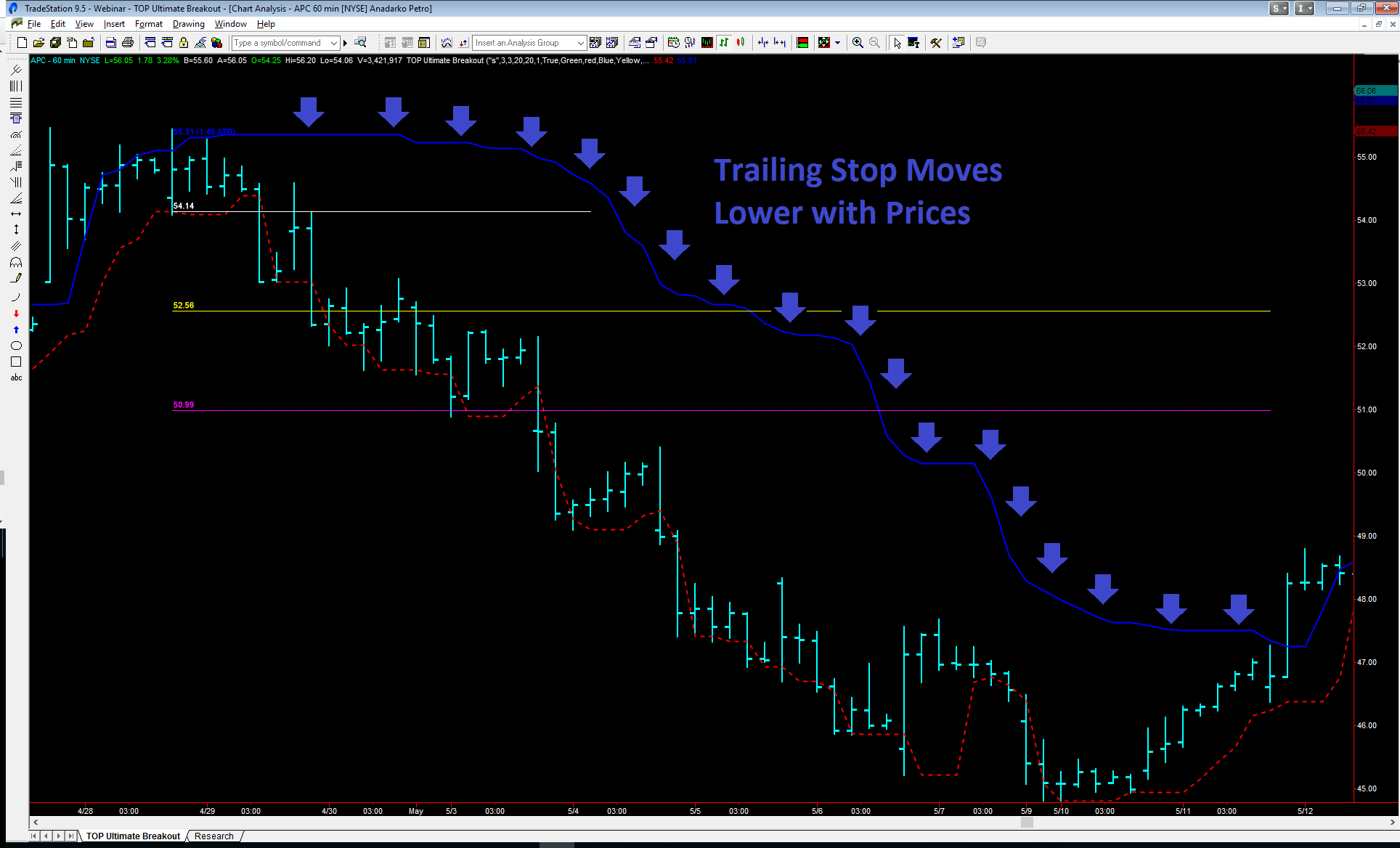

Below is an example of where you would place your stop in a Sell or Short trade. In this case, the Trailing Stop is positioned above the entry price level and trails prices as the market moves lower. Your Buy Risk Stop would be placed above the blue Trailing Stop Line for short trades.

What Can You Expect?

Should you expect the TOP Ultimate Breakout strategy to make money on every trade? No. The TOP Ultimate Breakout will have losing trades. No trading strategy can claim to have winning trades every time. However, we believe that the TOP Ultimate Breakout can generate impressive results when combined with high probability trade setups.

We recommend that you take the time to master this powerful trading tools. As with any skill in life, the more time you work with the TOP Ultimate Breakout, the more you will learn to master this powerful trading strategy. And we believe that this will go a long ways in helping you to consistently achieve profitability in the markets.

Keep in mind that you many have streaks of winning trades and streaks of losing trades. The key is to think in terms of probabilities. Be selective with your trading opportunities. We believe that one of the most powerful ways to trade any market is to combine high probability trade setups with powerful trading signals, like those generated from the TOP Ultimate Breakout strategy. If you trade the TOP Ultimate Breakout in the forecasted direction of high probability trade setups, then we believe that you can achieve consistent profitability over time.

Designed to Cut Losses and offer Multiple Profit Exits

Any professional trader or hedge fund manager will tell you that you must cut your losses. The TOP Ultimate Breakout is designed with this age old trading wisdom in mind. If the TOP Ultimate Breakout is wrong on a trade, it is designed to get you out quickly. If the TOP Ultimate Breakout has a winning trade, it is designed to give you the flexibility to exit winning trades at one of three possible exit locations, including Profit Target #1, Profit Target #2, or the Trailing Stop.

The easy-to-use TOP Ultimate Breakout puts advanced trading technology right on your chart, with the goal of giving you a major advantage over other traders in the markets!

TOP Ultimate Breakout for Day Trading

Many trading strategies are not made for Day Trading markets using 5 minute charts. The TOP Ultimate Breakout is different. The TOP Ultimate Breakout can be great for trading 5 minute charts across a number of markets, including ETFs, like in the DIA ETF in the example below.

Of the three trades displayed above, the TOP Ultimate Breakout made maximum profits on the first and third trades as these trades hit both Profit Target #1 and Profit Target #2. The middle trade was a losing trade. The Buy example in the DIA chart above shows the power of the TOP Ultimate Breakout to trade short-term time frames like 5 minute price bars. How is that for power and flexibility!

But it gets better! Not only can the TOP Ultimate Breakout be used for Day Trading with Buy Signals, but you can also use the TOP Ultimate Breakout to profit on Sell or Short Signals as well. See the DIA Sell Signal example below.

The TOP Ultimate Breakout works exactly the same way with short trades as with long trades, except the lines are positioned in reverse, with the Trailing Stop line above you Sell Entry Level and the Profit Targets below your Sell Entry Level.

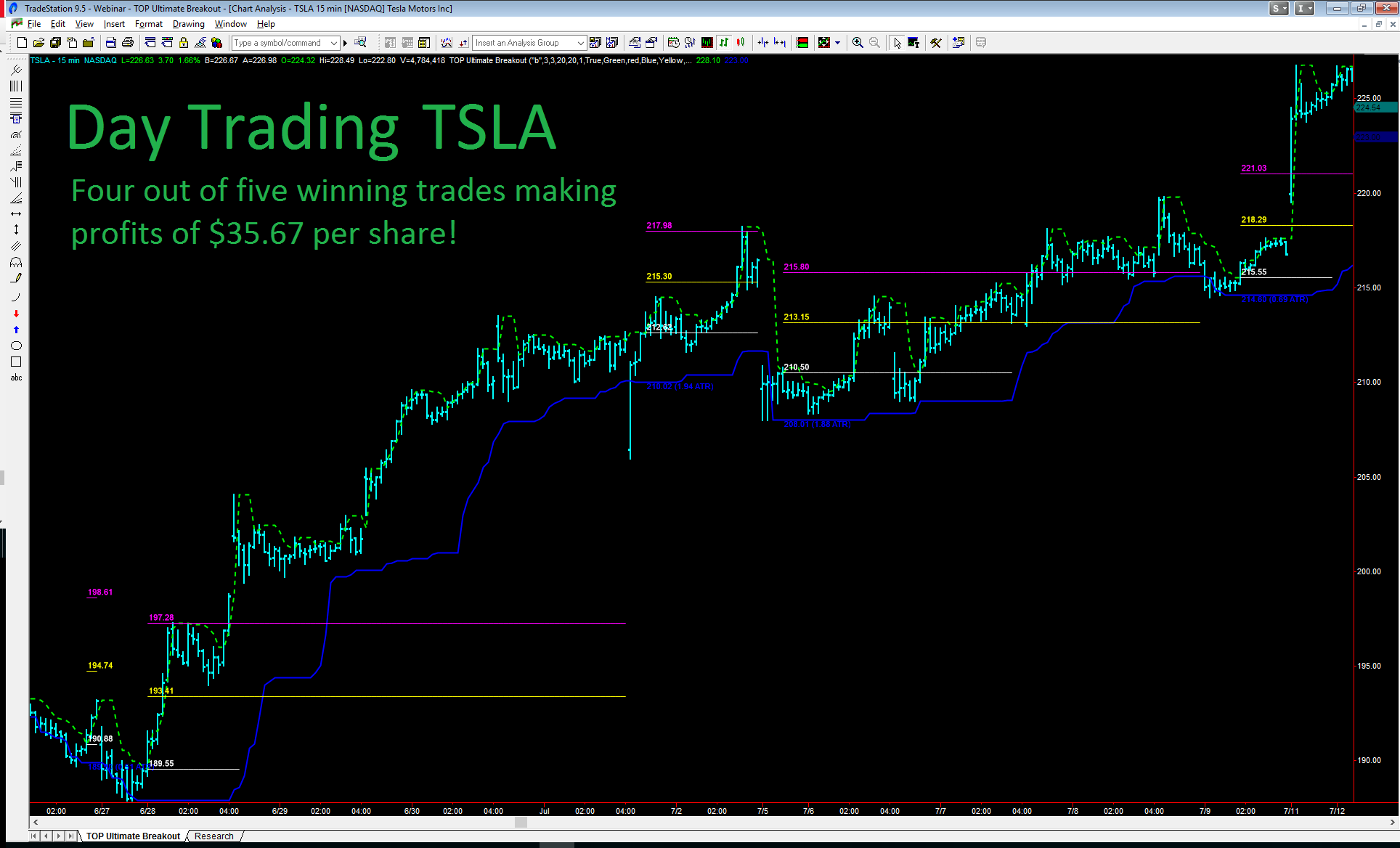

Works to Profit in Volatile Markets

When you find markets experiencing higher volatility, the TOP Ultimate Breakout can be used in volatile markets to capture sizable profits in day trading. In the TSLA example below, you can see several trade examples using 15-minute price bars.

TOP Swing Trader Pro

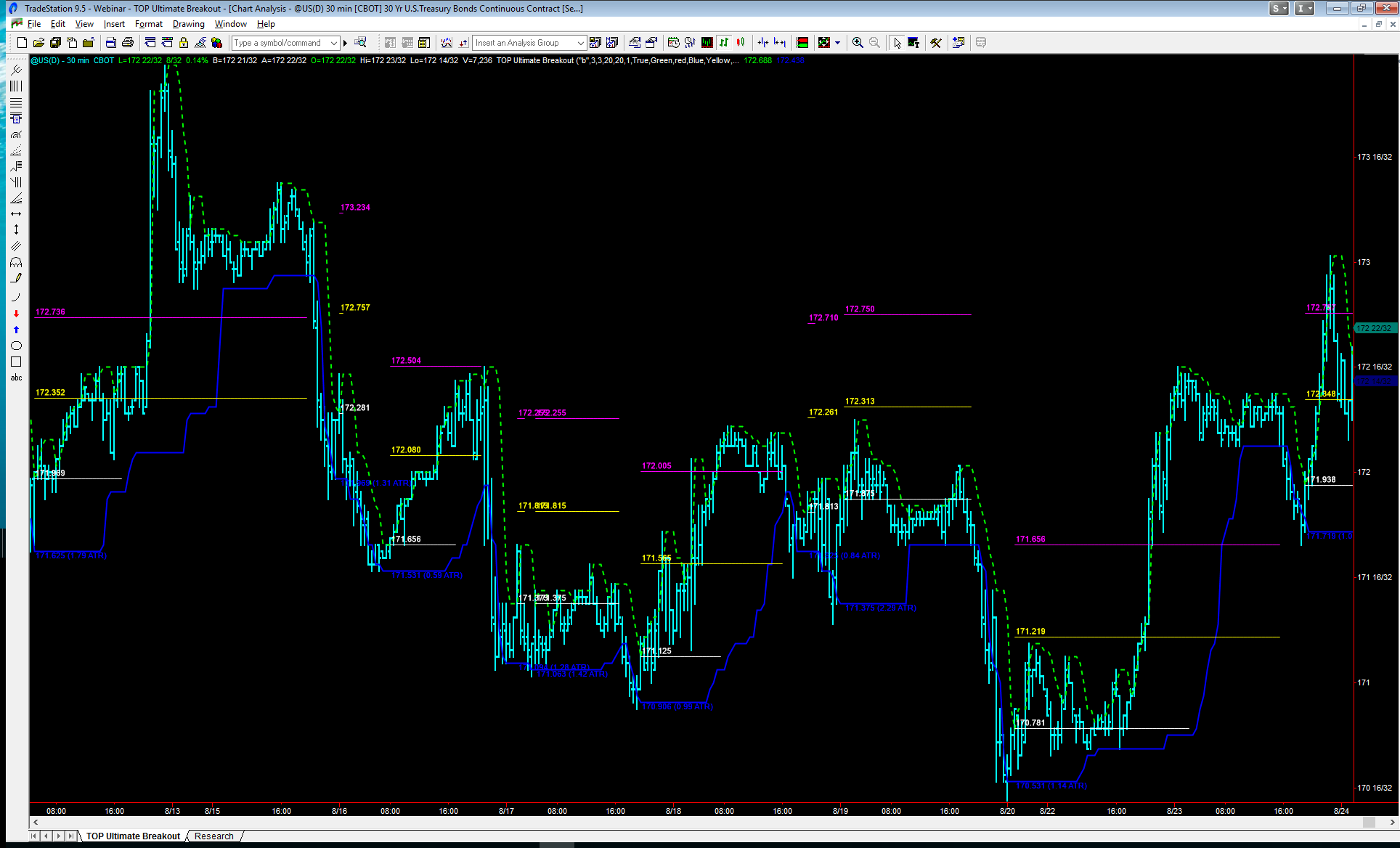

The TOP Ultimate Breakout can also be used to trade bonds and futures contracts. As stated previously, the best way to trade the TOP Ultimate Breakout strategy is to combine this strategy with high probability trade setups.

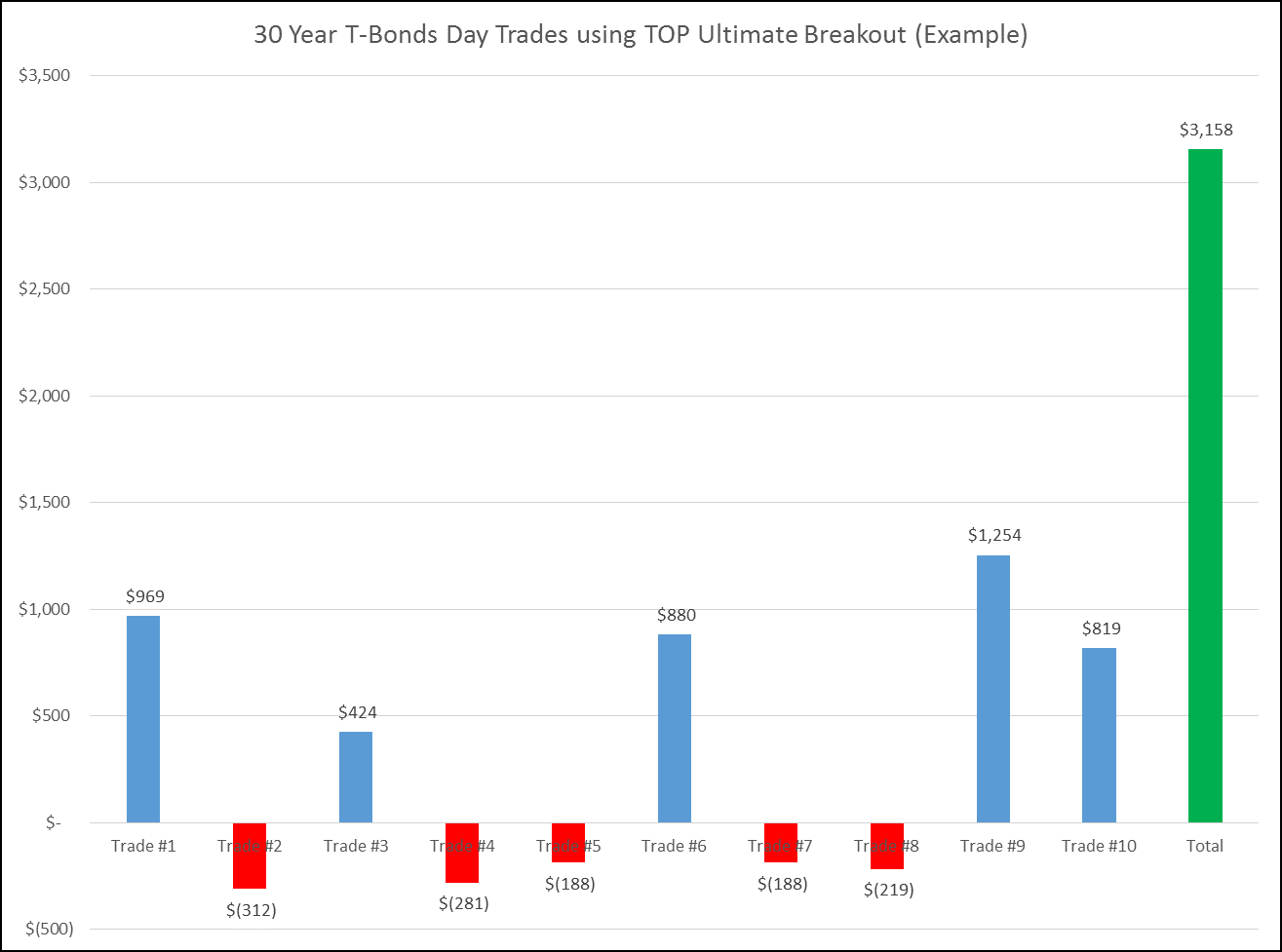

In the example below, we are displaying the last 10 trades from the 30-year bond futures on a 15 minute price chart. The chart below shows that bonds were extremely choppy and drifting downward, which makes this market a challenging candidate for buy signals.

Again, this is not a good example of a strategic trade entry based on high probability trade setups. This serves as an example to showcase the TOP Ultimate Breakout capabilities by taking all of the past 10 trades from the 30-year bonds, which demonstrates the effectiveness of the TOP Ultimate Breakout strategy even in tough, choppy market conditions.

There were five winning trades and five losing trades in the 30-year bond trading example above. Profits were calculated by using the max profit exit between Profit Target #1, Profit Target #2, or the Trailing Stop. If only Profit Target #1 was hit, we used this exit level. If the Trailing Stop was most profitable, we used this exit level. If no profit targets were hit, then trades were automatically exited at the Trailing Stop level. We did this to showcase the profit potential of the TOP Ultimate Breakout strategy. This example is a good reminder that there will be losing trades when trading in the markets.

In the 30-year bond example above, the TOP Ultimate Breakout was able to generate a total net profit of $3,158 per contract (not including commissions and trading fees) from the 10 trades. Again, this is not the way we recommend trading the TOP Ultimate Breakout strategy. However, because the TOP Ultimate Breakout is designed to cut losses short and offer multiple exit options for profitable trades, even in difficult markets, the TOP Ultimate Breakout strategy demonstrates its effectiveness.

It is important to remember that there is a risk of loss when trading and past performance is not necessarily indicative of future results. Be sure to read the hypothetical disclaimer at the bottom of the page.

TOP Ultimate Breakout

Profiting from Swing Trades

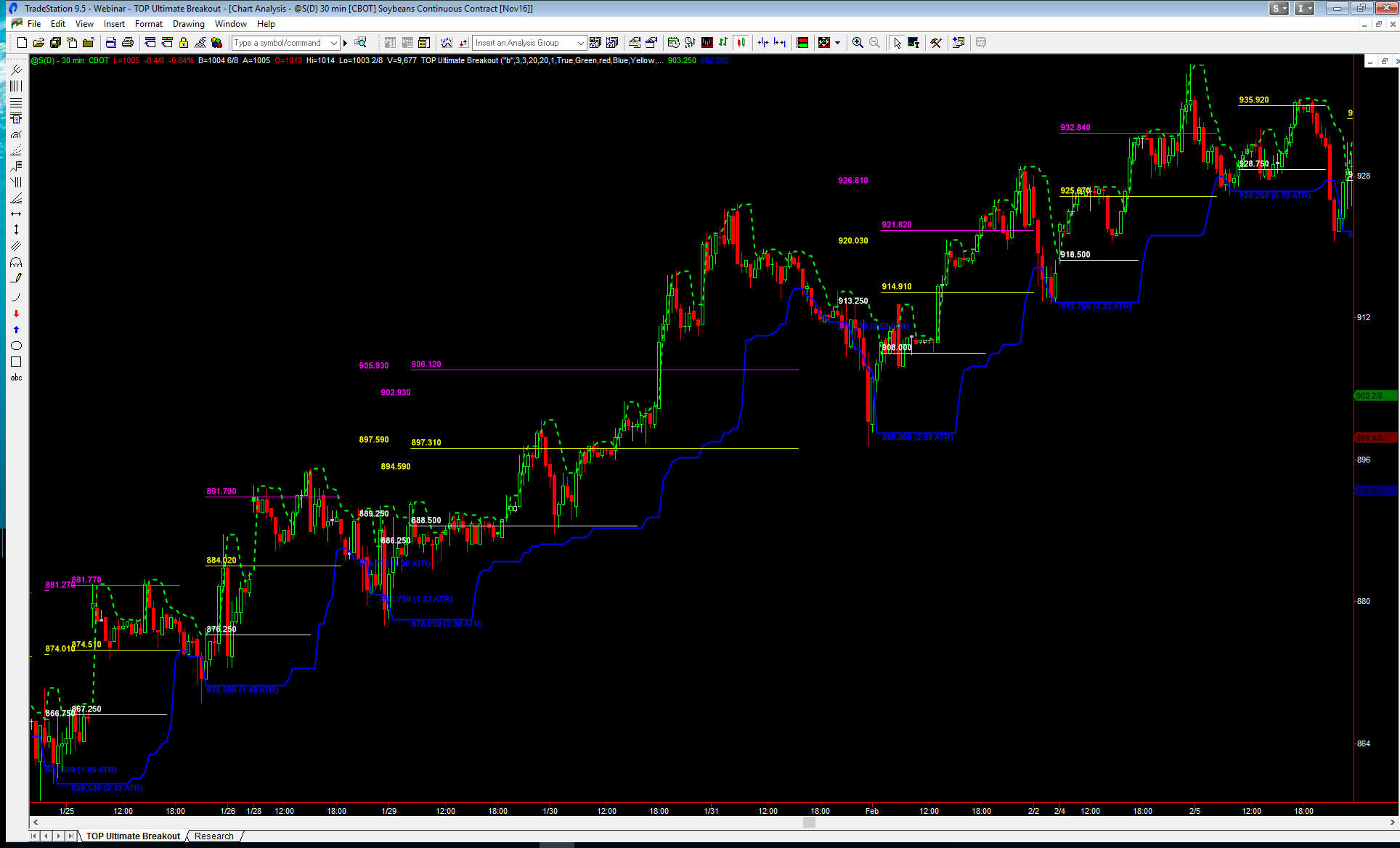

The Hammer Candlestick pattern can identify potential market bottoms or cycle lows in markets. Suppose that we wanted to buy Soybeans when we witnessed a Daily Hammer Candlestick pattern. The chart below identifies three Hammer Candlestick patterns, which will serve as Buy Trade setups.

Once we identify a Hammer Candlestick pattern on the daily Soybeans chart, we will drill down to a shorter time frame to generate our TOP Ultimate Breakout Buy Signals for each trade setup. In this case, we choose to use 30 minute Soybean price charts to generate our TOP Ultimate Breakout buy signals.

Daily Hammer Candlestick Setup #1

Daily Hammer Candlestick Setup #2

TOP Ultimate Breakout

Although the net trades generated from the TOP Ultimate Breakout in the second example above were profitable, there were a few losing trades as well. We never want to fool ourselves. We all will encounter losing trades over time with any strategy. The key is to cut losers short.

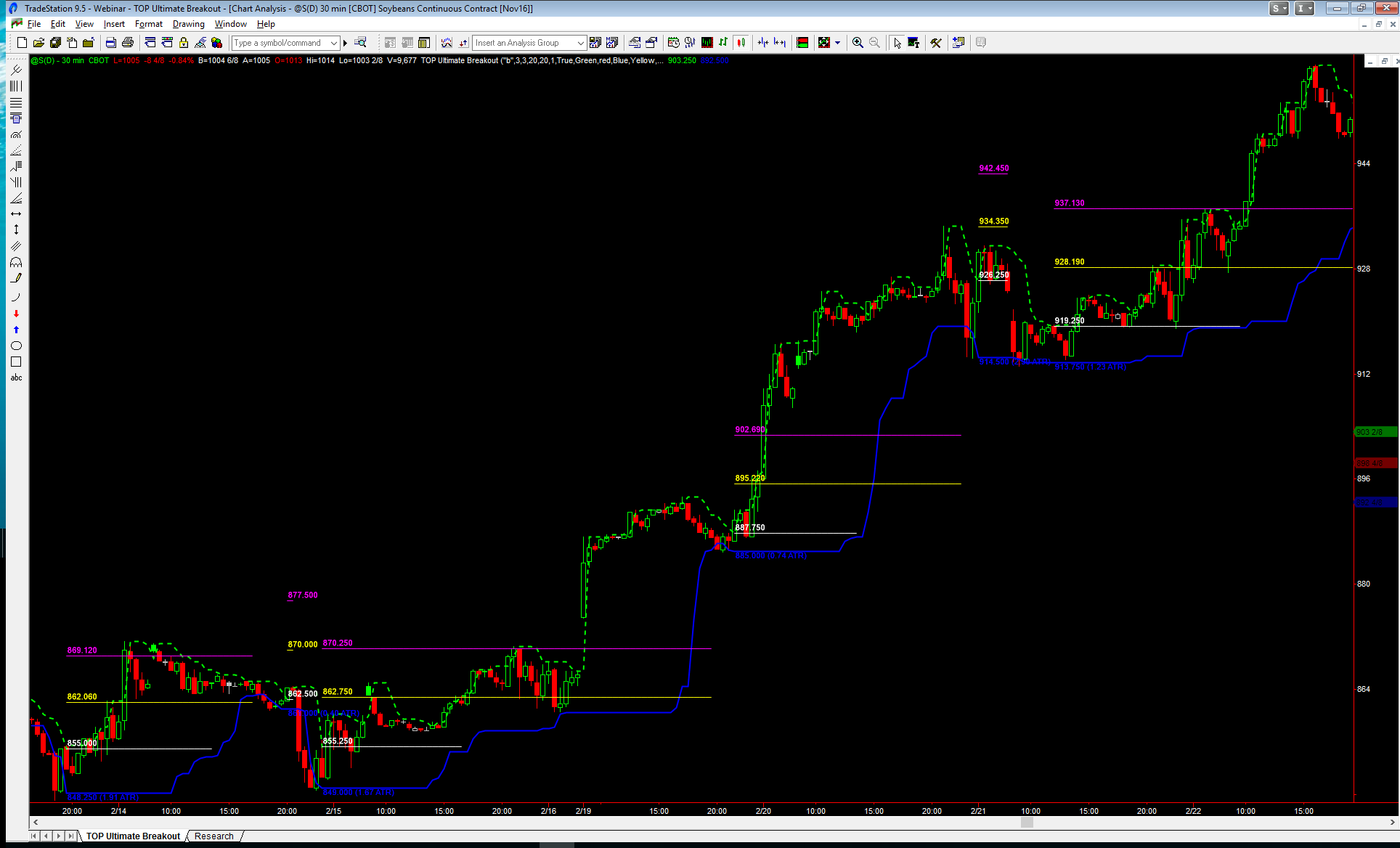

Daily Hammer Candlestick Setup #3

The TOP Ultimate Breakout trade examples above in the Soybeans market were generated from the third daily Hammer Candlestick Buy Setup pattern. These trades were net profitable.

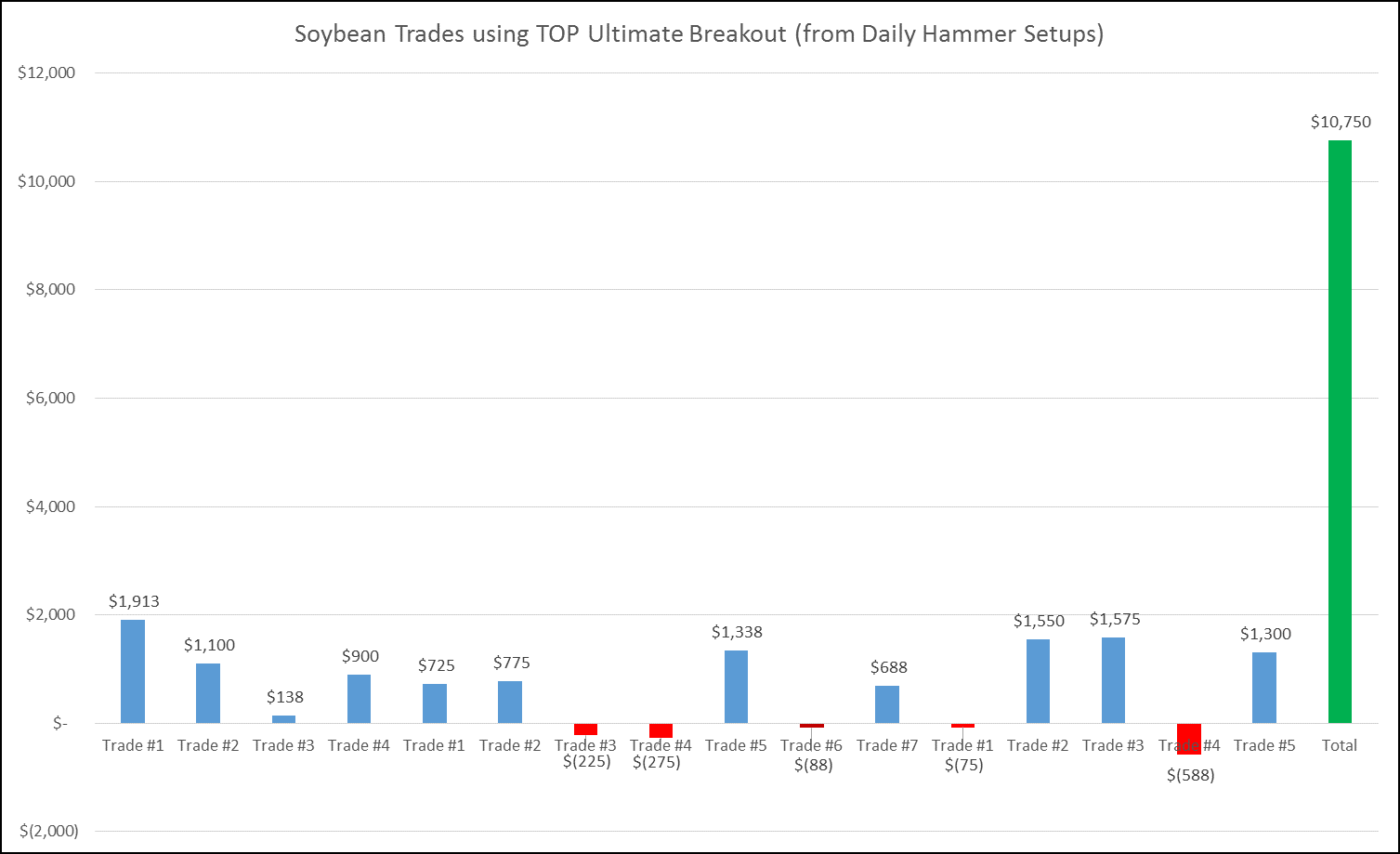

A Profit/Loss bar chart was generated from all of the TOP Ultimate Breakout trades from all three Soybeans Buy setups (see below).

TOP Ultimate Breakout

Although the TOP Ultimate Breakout strategy still experienced several losing trades, the net results from all three example Hammer Candlestick Buy Setups in the Soybeans market generated $10,750 in profits (not including commissions and trading fees). The Soybean examples above highlight the reason why we recommend combining high probability trade setups with the TOP Ultimate Breakout when trading the markets.

It is also important to remember that trade setups have shelf lives. This means that the predictive power of any trade setup dissipates over the following price bars after the trade setup. Take time to learn and practice the concept of shelf life with trade setups.

Similar to before, we calculated profits by using the max profit exit between Profit Target #1, Profit Target #2, or the Trailing Stop for the Soybean trade examples. Reference the 30-year bond example above for an explanation on how this was done.

How We Like to Trade the TOP Ultimate Breakout

When it comes to profiting in the markets, you want to put the odds for success in your favor. A well-designed approach to trading that leverages the power of the TOP Ultimate Breakout strategy can be a powerful approach to achieving consistent profitability in the markets.

We believe that one of the most powerful ways to trade the markets includes combining high probability trade setups with rule-based trade signals, like those generated by the TOP Ultimate Breakout strategy. One way to trade is to look for high probability trade setups on a longer-term time frame and then apply the TOP Ultimate Breakout strategy on a shorter-term time frame, similar to the Soybeans example above.

We also recommend not trading against the trend unless you have a very reliable counter-trend trade setup. Trading in the same direction of the trend will put the odds in your favor. In addition, you do not want to trade after a setup has expired. In other words, every trade setup has an effective forecasting period called a shelf life. Once a trade setup shelf life has expired, you do not want to continue taking trades based on the trade setup because the its effectiveness has dissipated and you no longer have a trading edge based on the setup.

It is not a good idea to trade in choppy, sideways markets where there is little price volatility. We recommend that you select markets that are experiencing good directional volatility when trading with the TOP Ultimate Breakout strategy.

TOP Ultimate Breakout

Get the TOP Ultimate Breakout Advantage Today!

New traders and professional traders alike can benefit from the power of the TOP Ultimate Breakout strategy for day trading, swing trading, and trend trading. The TOP Ultimate Breakout strategy can be used to trade Stocks, Bonds, ETFs, Options, Futures, FOREX, and CFDs. Now you can combine the power of high probability trade setups with the TOP Ultimate Breakout strategy to remove the guesswork from your trading. You no longer need to wonder where to Buy, Sell, or where to place your Risk Stops. The TOP Ultimate Breakout gives you the flexibility of exiting your profitable trades at two optimal Profit Targets or at the Trailing Stop. Click the button below to begin enjoying the advantages of the TOP Ultimate Breakout strategy!

TOP Ultimate Breakout

IMPORTANT NOTICE! No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading securities and options on equities, futures, and FOREX markets. Only risk capital should be used to trade. Trading securities is not suitable for everyone. Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but they also have large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures, options, or currencies. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results. TopTradeTools.com, including any of its affiliates, will not be liable for any indirect, incidental, or consequential losses or damages which may include but are not limited to any kind of losses or lost profits that may result from either technology or material posted on this website or in our presentations.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.