TOP Linear Compression Pro

with Advanced Volatility Crush Pattern Recognition

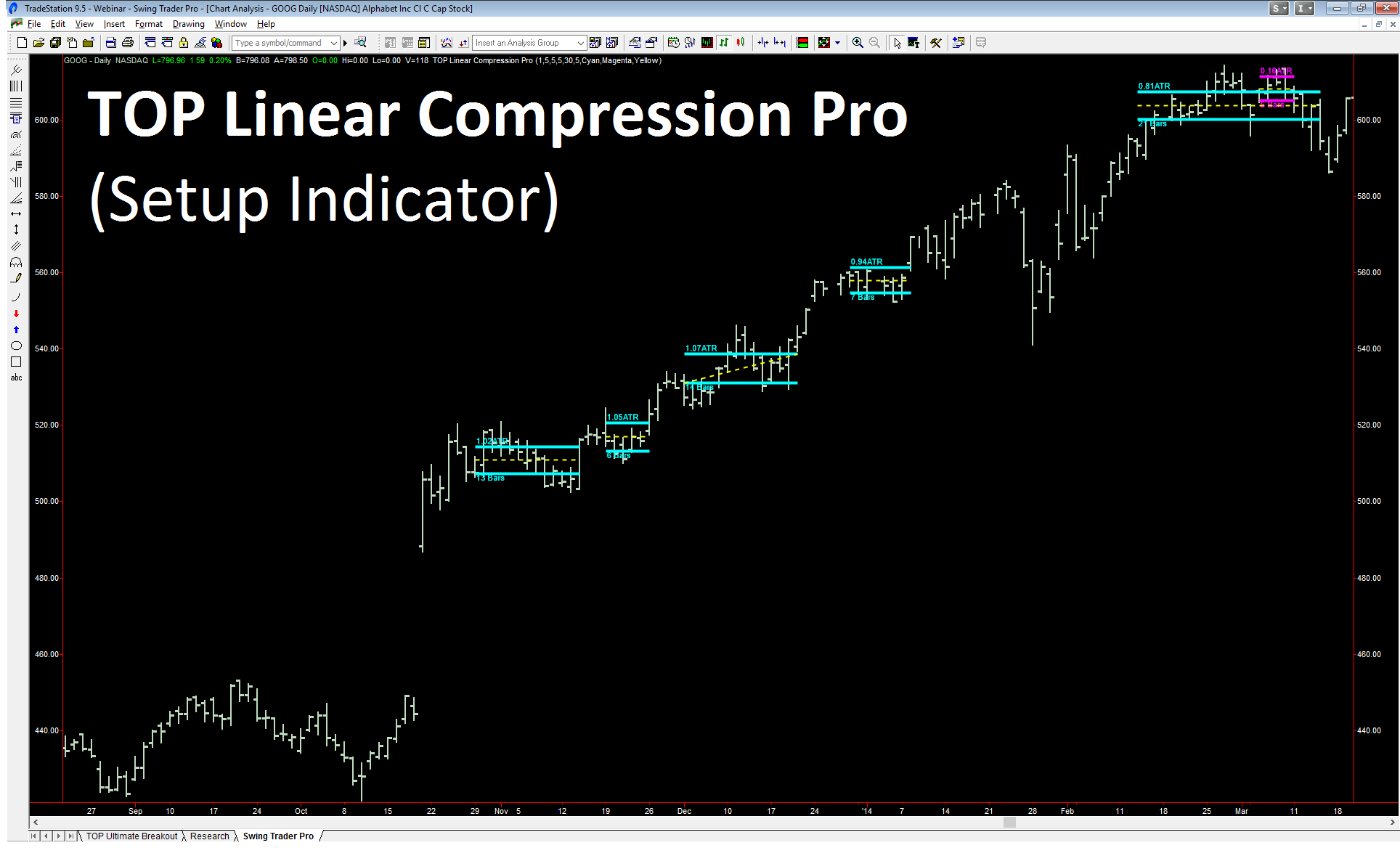

The TOP Linear Compression Pro indicator is designed to identify normal and extreme volatility crush compression trade setups for any market and timeframe combination.

Designed for Stocks, Bonds, Commodities, Futures, FOREX, and Options trading. TOP Linear Compression Pro is a powerful tool that can be used for Day Trading, Swing Trading, and for strategic entry Trend Trading! Effective on both intraday and end-of-day price charts including 5 minute charts, 60 minute charts, daily charts, weekly charts, and tick charts to name a few.

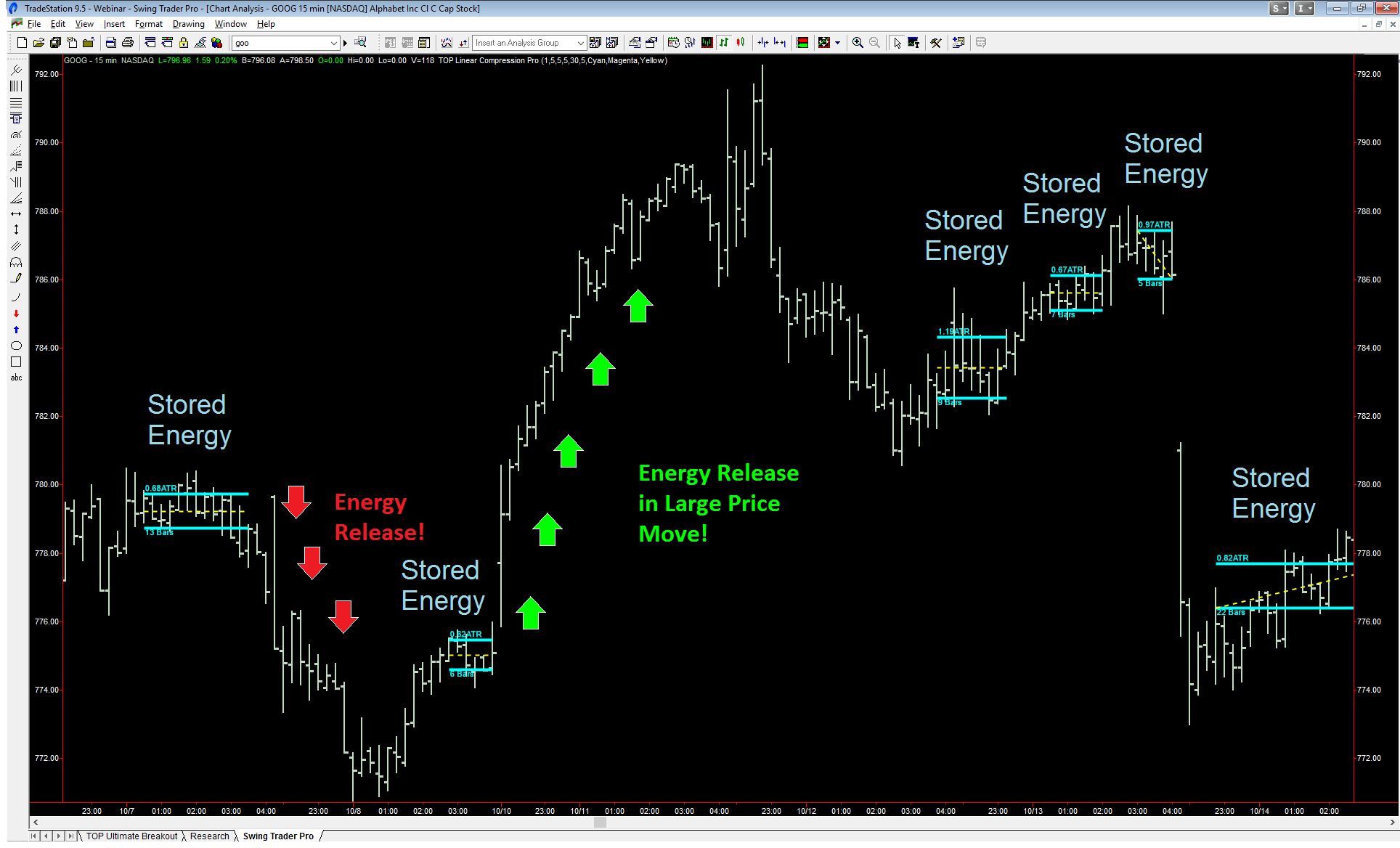

Markets tend to enter into volatility compression periods where significant energy can be stored for a future release. These volatility compression periods are often followed by volatility explosions where stored energy is quickly released and, as a result, prices experience a sizable move to the upside or the downside.

Some traders like to think of this as markets releasing energy when the slow compression periods ends by transitioning into a much more active periods that release stored energy and make up for lost time.

The volatility compression or “squeeze” trade setups have become increasingly popular in recent years. To help traders take advantage of these trading opportunities, we have developed a professional grade version of volatility compression pattern recognition software called the TOP Linear Compression Pro indicator.

Using a compression pattern recognition algorithm, the TOP Linear Compression Pro is designed to identify meaningful market price compression periods for any market and timeframe combination. Our empirical research has shown us that compression setups can be valid on all timeframes, including intraday price timeframes and end-of-day timeframes.

Easy to Use Compression Pattern Recognition Tool

Using linear based graphic components, we designed the TOP Linear Compression Pro indicator to be both visually attractive and easy to use. Each TOP Linear Compression Pro setup is plotted by using upper and lower linear boundary lines along with a center linear reference line. Because each price compression setup is unique in duration, the TOP Linear Compression Pro indicator plots the unique compression setup length associated with each volatility compression trade setup.

Not all linear volatility compression setups will lead to large price moves. However, as many professional traders will tell you, when the sizable “energy releasing” price moves occur, linear compression setups can represent excellent profit opportunities.

Advanced Pro Features

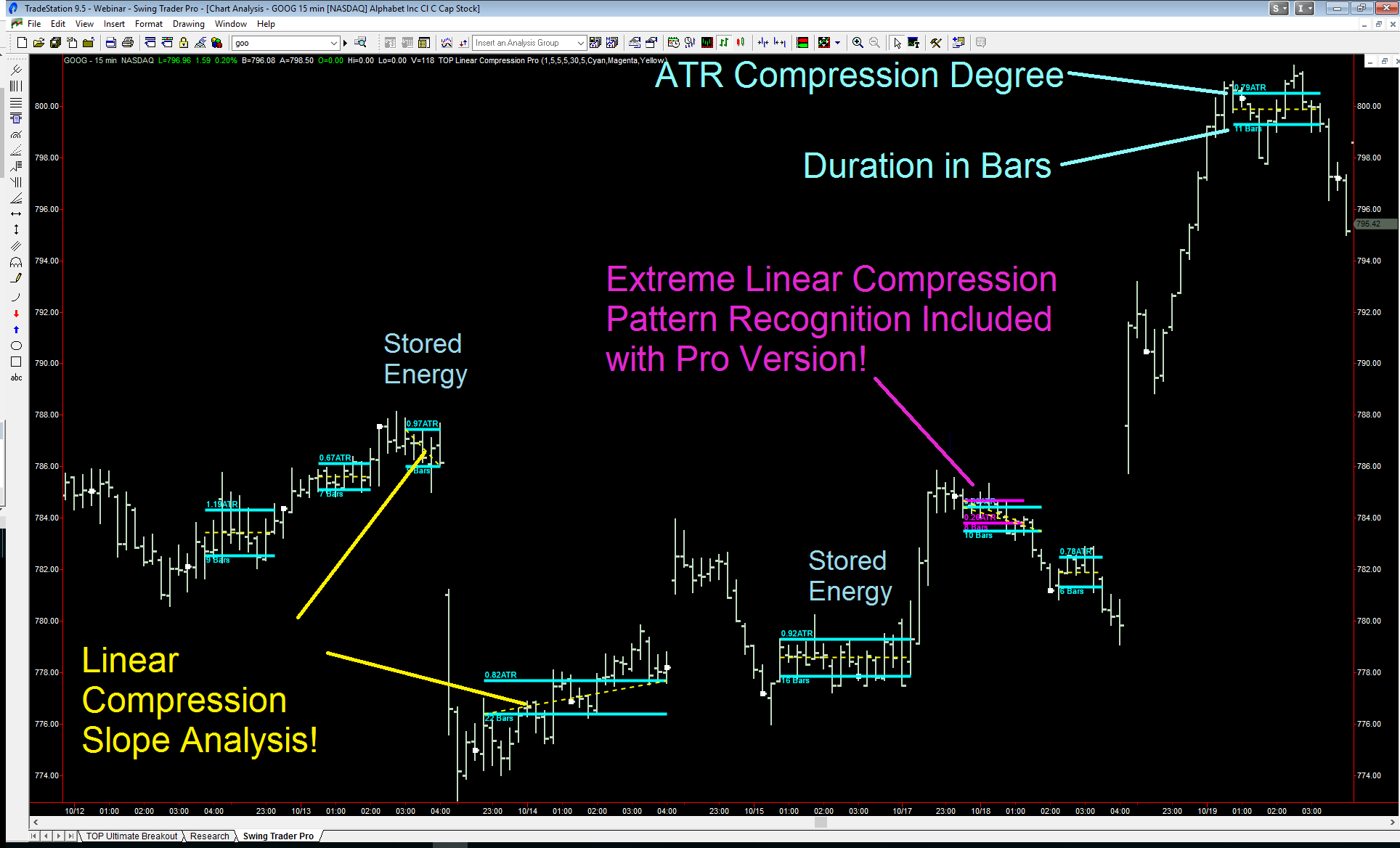

You can see in the GOOG 15 minute chart above that advanced information is communicated with the TOP Linear Compression Pro indicator. In addition to identifying normal and extreme (identified by the magenta lines in the chart above) linear volatility compression setups, the TOP Linear Compression Pro also analyzes the linear regression slop of each volatility compression setup and displays the compression degree (in ATRs) and the duration in price bars.

Extreme linear volatility compression setups (identified by the magenta lines in the chart above) involve an extreme drop in trading volatility beyond normal compression parameters. Sometimes when extreme linear volatility compression setups occur along with normal volatility compression setups, a market is about to experience a large price move.

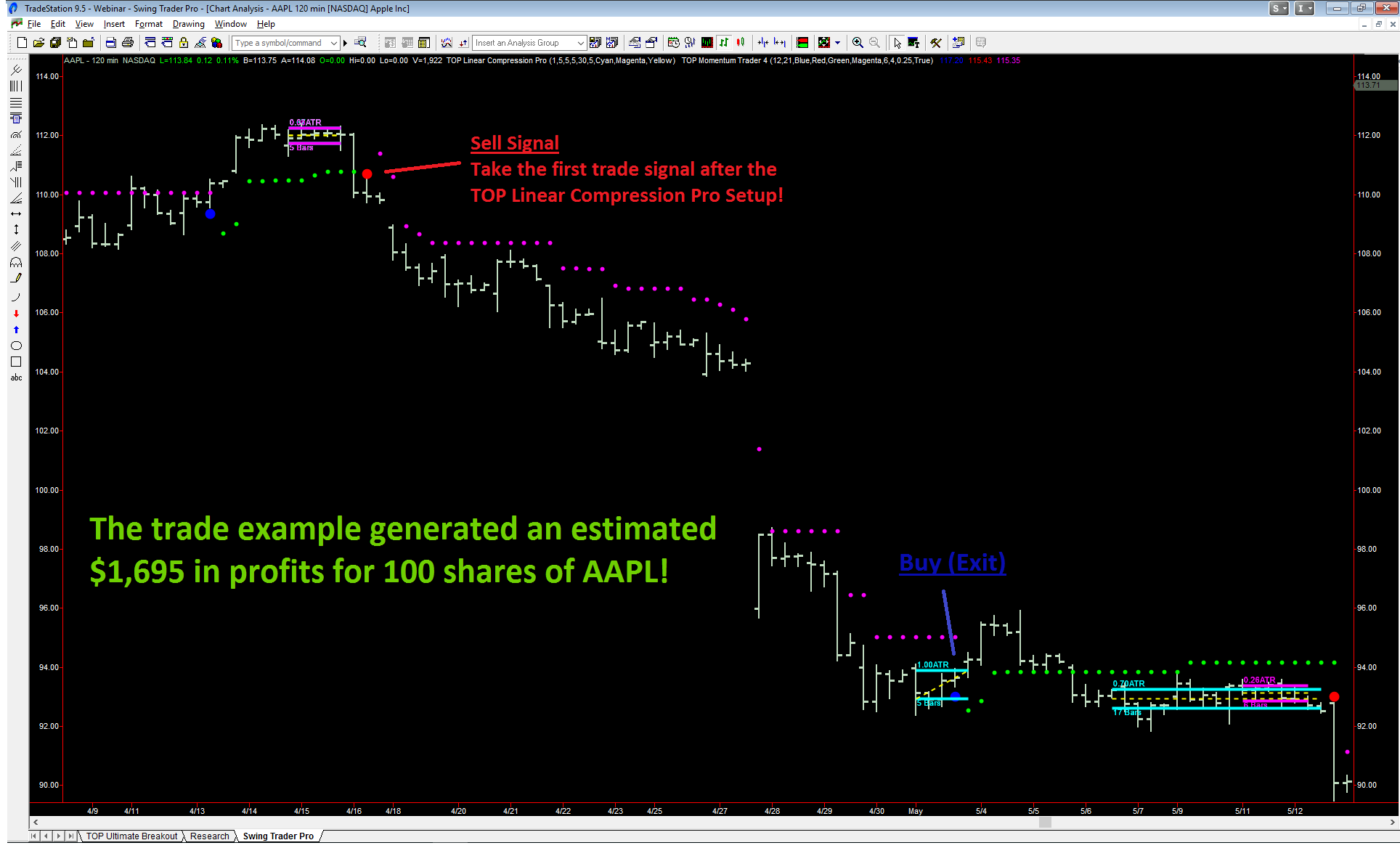

Using a Strategy with Pro Volatility Compression Setups

One powerful way to potentially profit from TOP Linear Compression Pro setups is to apply rule-based trading strategy signals following the Pro volatility compression trade setups. We believe that one of the most powerful ways to trade markets is to combine high probability trades setups with professional grade trading strategy signals. Let’s take a look at a hypothetical trading example below (see trading risk disclaimer at the bottom of this webpage).

In the example below, we apply the TOP Momentum Trader 4 along with the TOP Linear Compression Pro indicator to a 30 minute chart of Amazon. This strategy is simple – take the trade signals from TOP Momentum Trader 4 after any TOP Linear Compression Pro trade immediately following volatility compression trade setups.

In the AMZN 30 minute chart example above, the TOP Momentum Trader 4 buy signal immediately following the volatility compression trade setup (identified by TOP Linear Compression Pro) generated estimated profits of $2,464 for 100 shares of Amazon stock, excluding commission, slippage, and trading fees. This example demonstrates the strong potential profits that can be realized after a TOP Linear Compression Pro trade setup (hypothetical trade risk disclaimer at the bottom of webpage).

Although it is difficult to see in the chart above, the first TOP Linear Compression Pro setup represented an extreme setup (identifiable in Pro version only) with an degree reading of 0.63 ATR, which is a rare compression setup.

In the AAPL 120 minute chart example above, the TOP Momentum Trader 4 sell signal immediately following the extreme volatility compression trade setup (identified by TOP Linear Compression Pro) generated estimated profits of $1,695 for 100 shares of Apple stock, excluding commission, slippage, and trading fees. This example demonstrates the strong potential profits that can be realized after a TOP Linear Compression Pro extreme compression trade setup (hypothetical trade risk disclaimer at the bottom of webpage).

Now, it is important to understand that not all TOP Linear Compression Pro trade setups will lead to strong, explosive price moves. There is no trade setup in the world that can guarantee results every time. The key, in our opinion, is to find volatility compression periods in markets that tend to be more volatile over time. Stay away from thinly traded, inactive markets.

Risk Disclaimer: There is a risk of loss in trading and past performance is not necessarily indicative of future results.

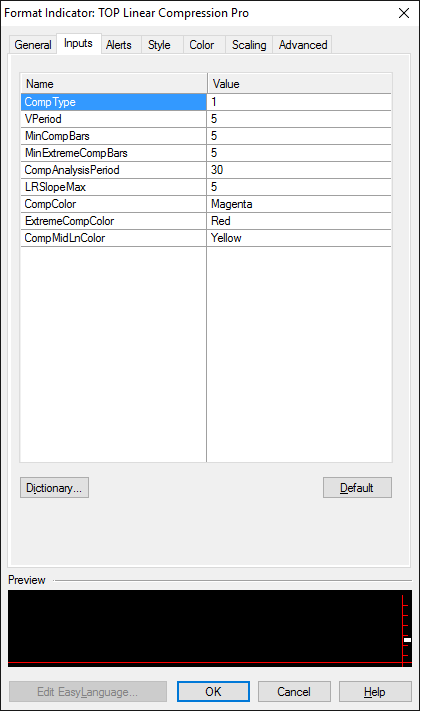

Simple Indicator Parameters

We have designed the TOP Linear Compression Pro indicator to be both powerful and easy to use. Our default settings represent our recommended settings. However, if you wish, you can adjust the TOP Linear Compression Pro settings to refine your volatility compression setup searches using your preferred parameter settings.

The TOP Linear Compression Pro allows you to select from three different price compression types, including Regular (Set CompType to 1), Median Bar Price (Set CompType to 2), and Extreme Price (Set CompType to 3).

The VPeriod parameter will modify the volatility algorithm look back period. Smaller values for this parameter will make the TOP Linear Compression Pro indicator more reactive (shorter-term) and larger values will make it less reactive (longer-term) to volatility compressions.

The MinCompBars (Minimum Compression Bars) parameter defines the minimum number of price bars that you require for a TOP Linear Compression trade setup to be plotted. A value of 5 means that there must be a volatility compression for at least 5 price bars before a plot is generated. The MinExtremeCompBars (Minimum Extreme Compression Bars) parameter defines the minimum number of price bars that you require for a TOP Linear Extreme Compression Pro extreme trade setup to be plotted.

The CompAnalysisPeriod parameter defines the maximum number of bars that will be evaluated for any volatility compression.

The LRSlopeMax parameter defines the maximum linear regression slope angle for regular linear compressions. If the absolute value of the linear regression slope angle for any linear volatility compression is greater than this parameter setting than the displayed middle dashed line for any TOP Linear Compression will slope upward or downward, depending on the direction of the linear regression slope angle.

The last three parameters simply allow you to select the colors of the TOP Linear Compression Pro setup lines.

Get the TOP Linear Compression Pro Advantage Today!

Both new traders and professional traders alike can benefit from the power of the TOP Linear Compression Pro indicator for day trading, swing trading, and trend trading. The TOP Linear Compression Pro indicator can be used to trade Stocks, Bonds, ETFs, Options, Futures, FOREX, and CFDs. Now you can learn to find high probability trade setups based on volatility compression using the TOP Linear Compression Pro indicator. Get the professional grade TOP Linear Compression Pro advantage today by clicking the button below!

IMPORTANT NOTICE AND DISCLAIMER

Futures, Options, and Currency trading all have large potential rewards, but they also have large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy or Sell stocks, options, futures, of FOREX. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results. TopTradeTools.com, including any of its affiliates, will not be liable for any indirect, incidental, or consequential losses or damages which may include but are not limited to any kind of losses or lost profits that may result from either technology or material. No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading securities and options on equities, options, futures, and FOREX markets. Only risk capital should be used to trade. Trading securities is not suitable for everyone. Disclaimer: posted on this website or in our presentations.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.