Hedge Fund Trender

The Hedge Fund Trender is modeled after a successful hedge fund trading strategy used to manage millions of dollars in the markets. As one of three core strategies, the HFT helped our hedge fund win top hedge fund of the year honors in Futures Magazine.

Simple DOT Signals

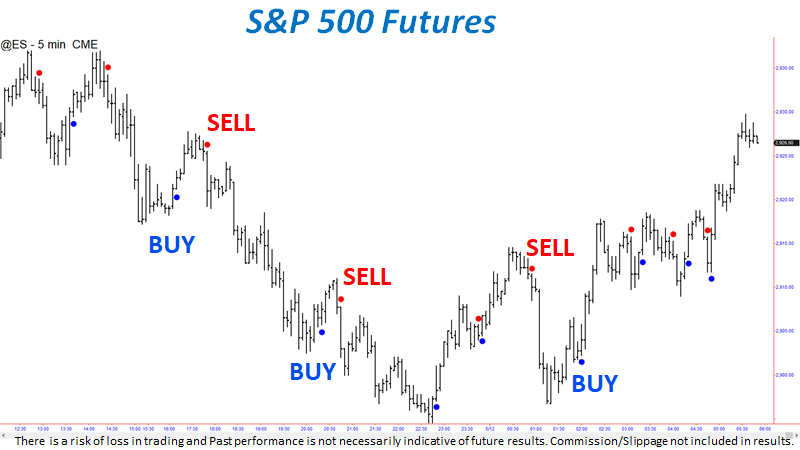

Designed with the goal of making trading signals as simple as BLUE DOT BUY and SELL DOT SELL, the HFT trading strategy is so simple, I taught it to may 8th grade daughter in less than 5 mins.

By plotting simple BUY and SELL signals on price charts, you can easily see when trading signals unfold in the markets that you trade.

Able to Trade Stocks, Options, Futures and FOREX

The HFT is a strategy that can be used to trade all markets, including stocks, options, futures, and forex markets.

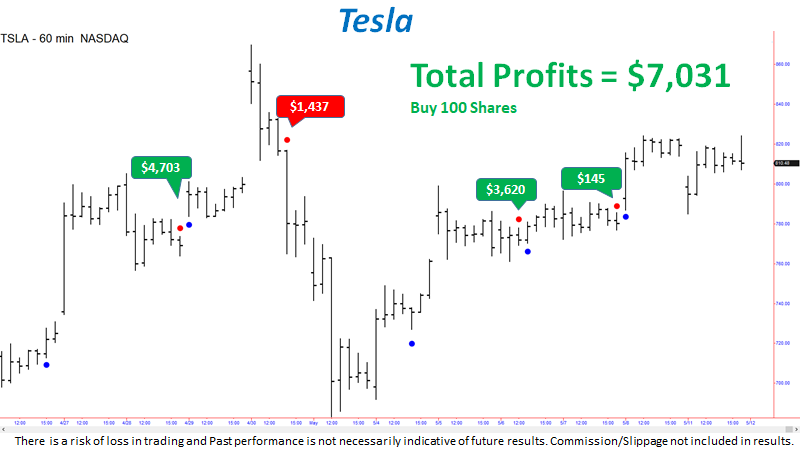

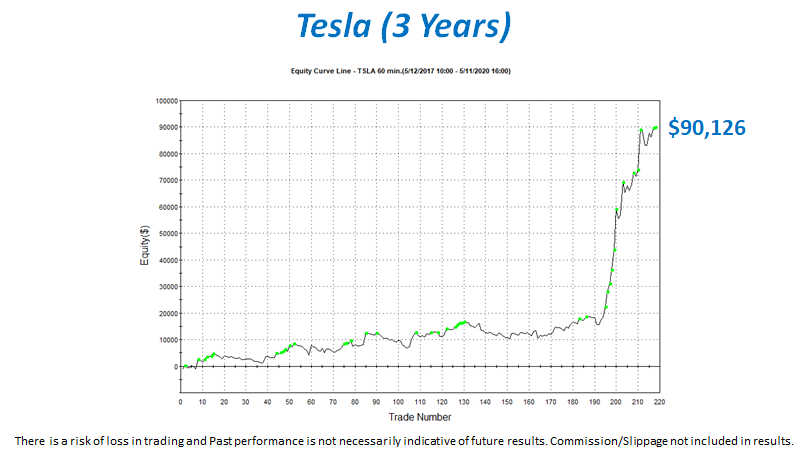

See in the chart above how simple it was to see when to BUY or SELL short stock in TSLA. Over the last three years, the HFT buy signals have made significant profits in TSLA in the example below.

Disclaimer: Review hypothetical disclaimer at the bottom of page. Past performance is not necessarily indicative of future results and there is a potential for profits and a risk of loss when trading.

High Probability Trade Setups

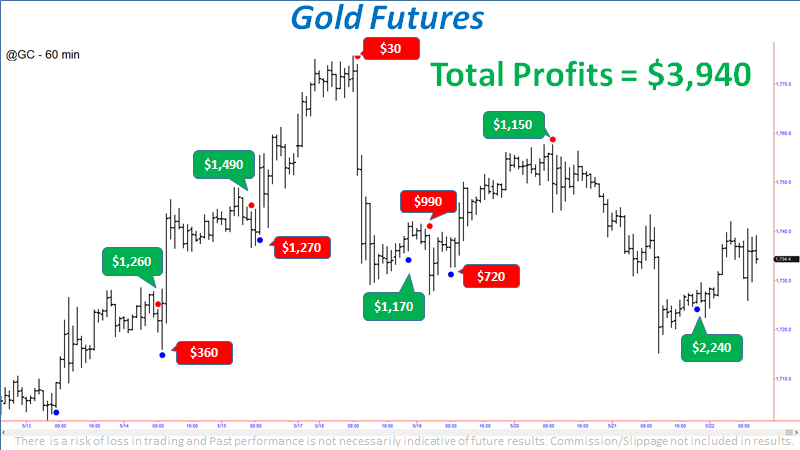

We recommend using the HFT in situations where you have a high probability trade setup with a strong directional forecast. This can significantly improve your profitability over the long-term. However, there are times when markets experience strong directional moves where the HFT can be profitable like in the Gold example below.

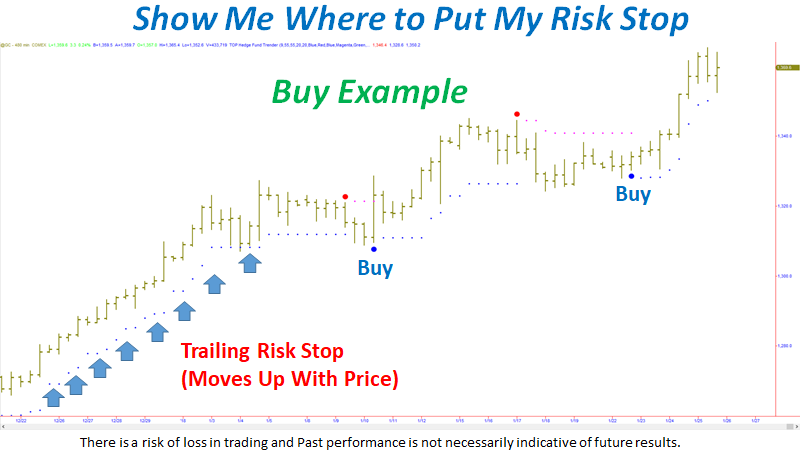

Intelligent Trailing Stop

An additional feature in the HFT is an advanced trailing stop that you can use to manage trades and potentially lock in profits, showing you exactly where to place your risk stop for your trades.

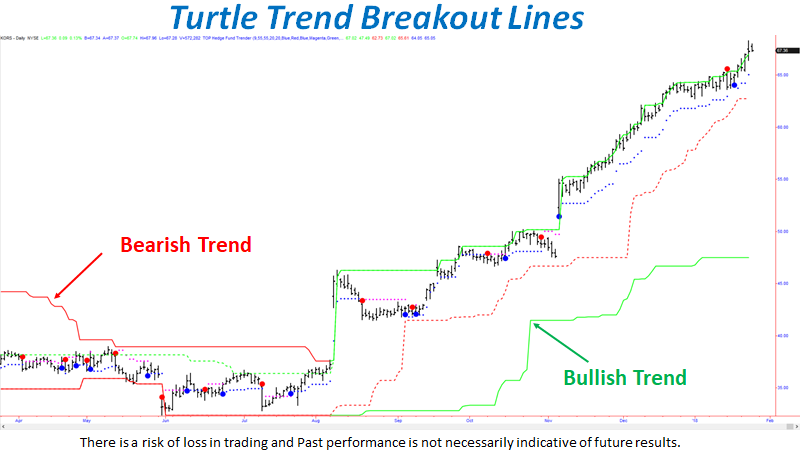

Bonus Trend Strategy Lines

As a bonus, we also included optional longer-term trend breakout lines that you can use to potentially turn short-term winning trades into long-term much larger winning trades. The breakout lines turn green during bull trends or red during bear trends.