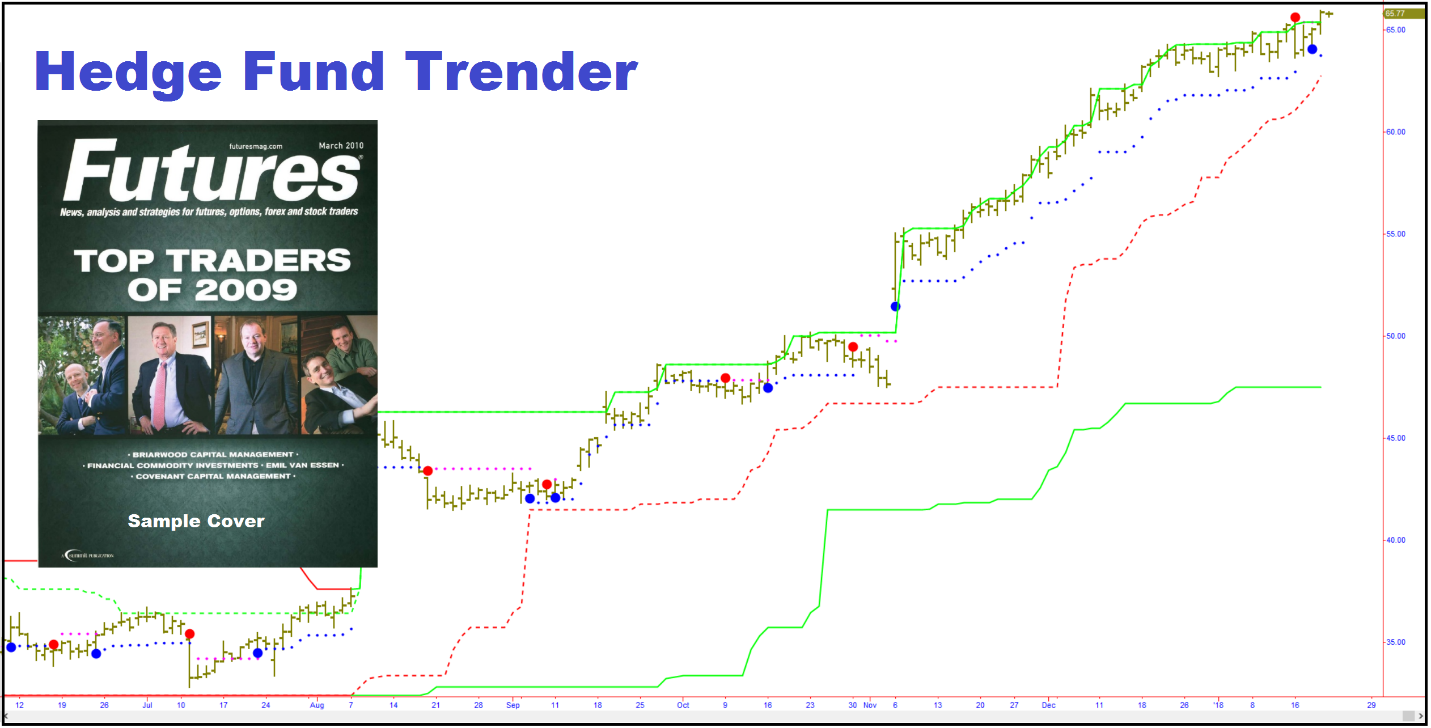

Hedge Fund Trender

Hedge Fund Trender built on actual Hedge Fund Strategy

When we launched our first hedge fund many years ago, we focused on utilizing a core group of robust trading strategies that were designed using time-tested algorithms. We wanted trading strategies that would be effective in capturing profits from significant directional price moves in the markets. Managing millions of dollars of actual client money with this strategy as one of our core strategies, we were recognized as a Hot New CTA (Hedge Fund) in Futures Magazine! But we have made a good thing better! We worked to make the Hedge Fund Trender better than our original version by improving on the original strategy that helped us win the recognition in Futures Magazine. Our improvements were achieved by incorporated our new CBR ProTM Signal Technology. But that’s not all. We also designed a simple yet powerful trend following overlay to give traders the ability to both profit from price swings in markets and, if they choose, profit from long-term trends that unfold over time. It’s designed to be an All-In-One trading strategy!Easy to Follow Trading Signals!

The Hedge Fund Trender makes powerful hedge fund trading signals easy for you to follow. You no longer have to worry about setting any complex parameter settings. All you have to do is follow the Dots. You choose two colors and let Hedge Fund Trender do the rest!

You can now take the guess work out of your trading analysis by simply following the Hedge Fund Trender Dots. Trading signals don’t not get much easier than this. The Hedge Fund Trender is designed to effectively capture profits from significant directional price moves in any market. However, similar to any strategy, we recommend strategically applying the Hedge Fund Trender to the markets when you identify potential high probability trade setups (See How We Recommend using Hedge Fund Trender below).

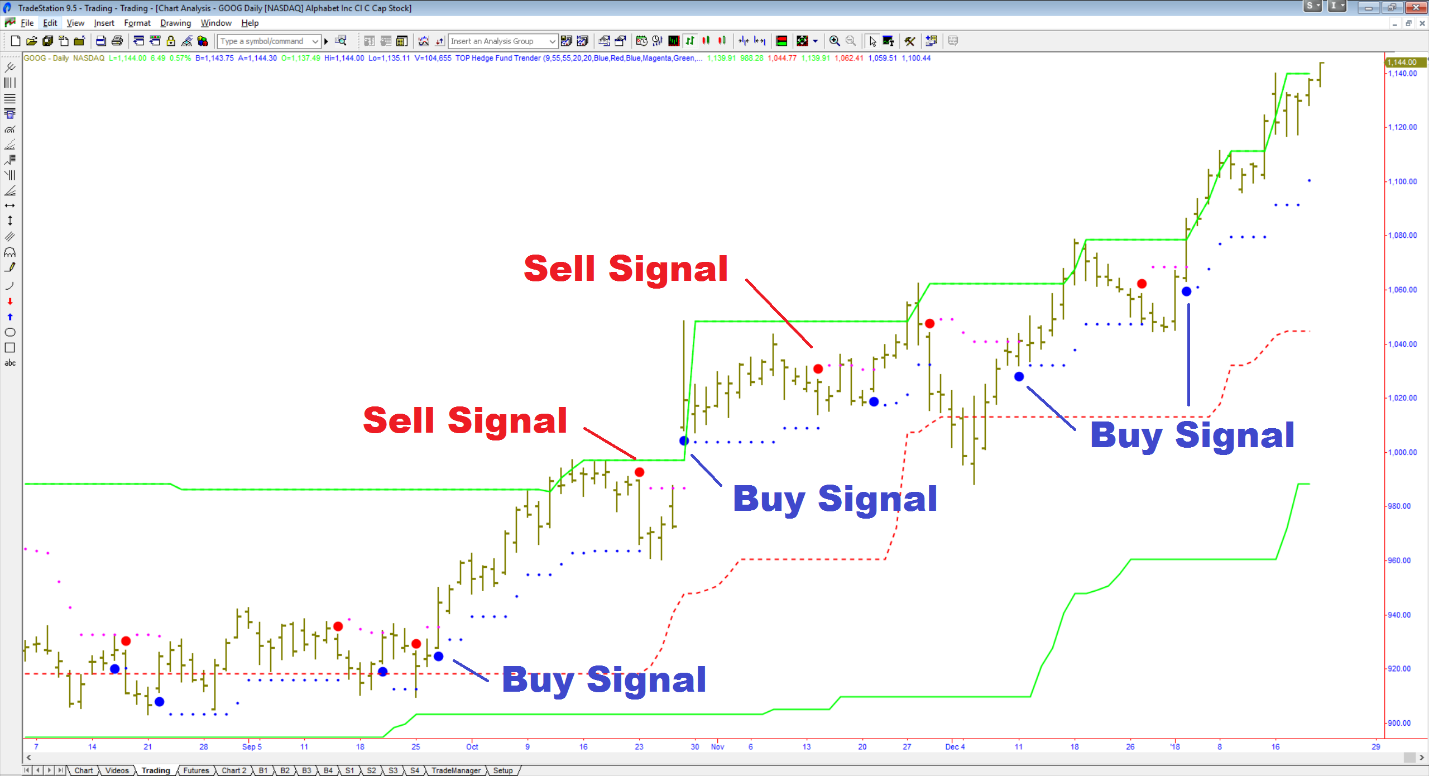

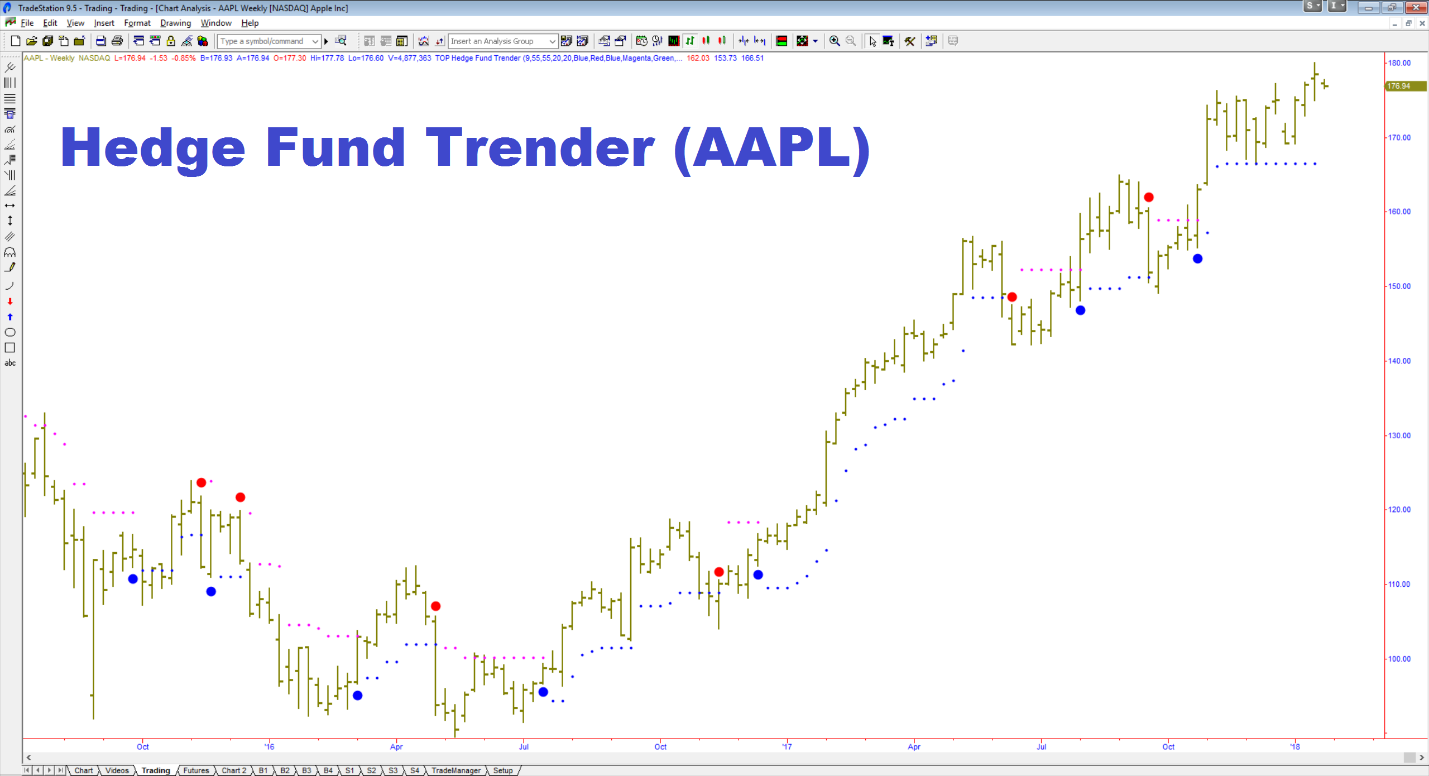

Signal Dots Right on Your Chart

The Hedge Fund Trender will plot easy to read Buy Dots and Sell Dots right on your chart!

• Hedge Fund Trender Buy Dot

• Hedge Fund Trender Sell Dot

Remove Destructive Emotions from Trading

Greed and fear may have done more to derail traders over the years than just about anything else. Every professional trader will tell you that you must keep your emotions in check in order to make money consistently in the markets.

Take the Guesswork out of Trading with Hedge Fund Trender

Take the guess work out of trading with an actual hedge fund inspired trading strategy used in the Hedge Fund Trender. Regardless of whether you Day Trade, Swing Trade, or Trend Trade, the Hedge Fund Trender can help you identify high quality trading signals in the markets when your research tells you that a big price move is about to happen. Now you can trade both intraday short-term trades or end-of-day longer-term trades. The Hedge Fund Trender can be used with all trading timeframe. We recommend trading markets with strong directional movement. The Hedge Fund Trender can be applied to both short-term intraday day trading (5 min, 30 min, and 60 min price charts or Tick Charts) and longer-term end-of-day trading (Daily, Weekly, or Monthly price charts).

IntelliStepTM Trailing Stop

It is considered a good practice to place a protective risk stop in a market when you initiate a trade. We believe that you are going to love what we have developed for the Hedge Fund Trender to help you strategically place your stops. IntelliStepTM Trailing Stop Dots uses an advanced algorithm to strategically identify optimal trailing stop levels.

Hedge Fund Trender Helps You Position Stops

Placing risk management stops in the markets is one of the most challenging aspects of trading. If you place stops to close to entries, you run the risk of getting stopped out of trades that end up becoming winners. If stops are too far away from your entries, then you end up risking too much. The IntelliStepTM trailing chart dots are designed to help you position Hedge Fund Trender risk stops in the markets. Because placing stops in any market is challenging, we developed IntelliStepTM trailing stop dots to both help you control risk and to help you capture profits.

How we recommend using Hedge Fund Trender Indicator

The Hedge Fund Trender is designed to capture profits from directional price moves in any market. However, as any professional trader will tell you, markets can experience choppy, sideways conditions. We do not recommend trading in these market conditions as you will increase your chances of false signals and losing trades. Difficult, choppy conditions cause most trading strategies to lose money. So we recommend avoiding them altogether. Instead, we recommend applying the Hedge Fund Trender to markets with strong direction volatility or when you identify a high probability trade setup. If you are new to trading, you can benefit from learning about proven trade setups. We recommend that you consider the Top Trade Tool monthly membership, which is designed to teach you how to trade the markets. We believe that both new traders and seasoned professionals alike can learn the skills of identifying powerful trade setups in real time. Our monthly membership can help with this. And once you learn to recognize a number of proven trade setups, you will simply want to consider following the Hedge Fund Trender signal dots in the direction of each trade setup. It’s that easy and it’s a powerful approach to trading.

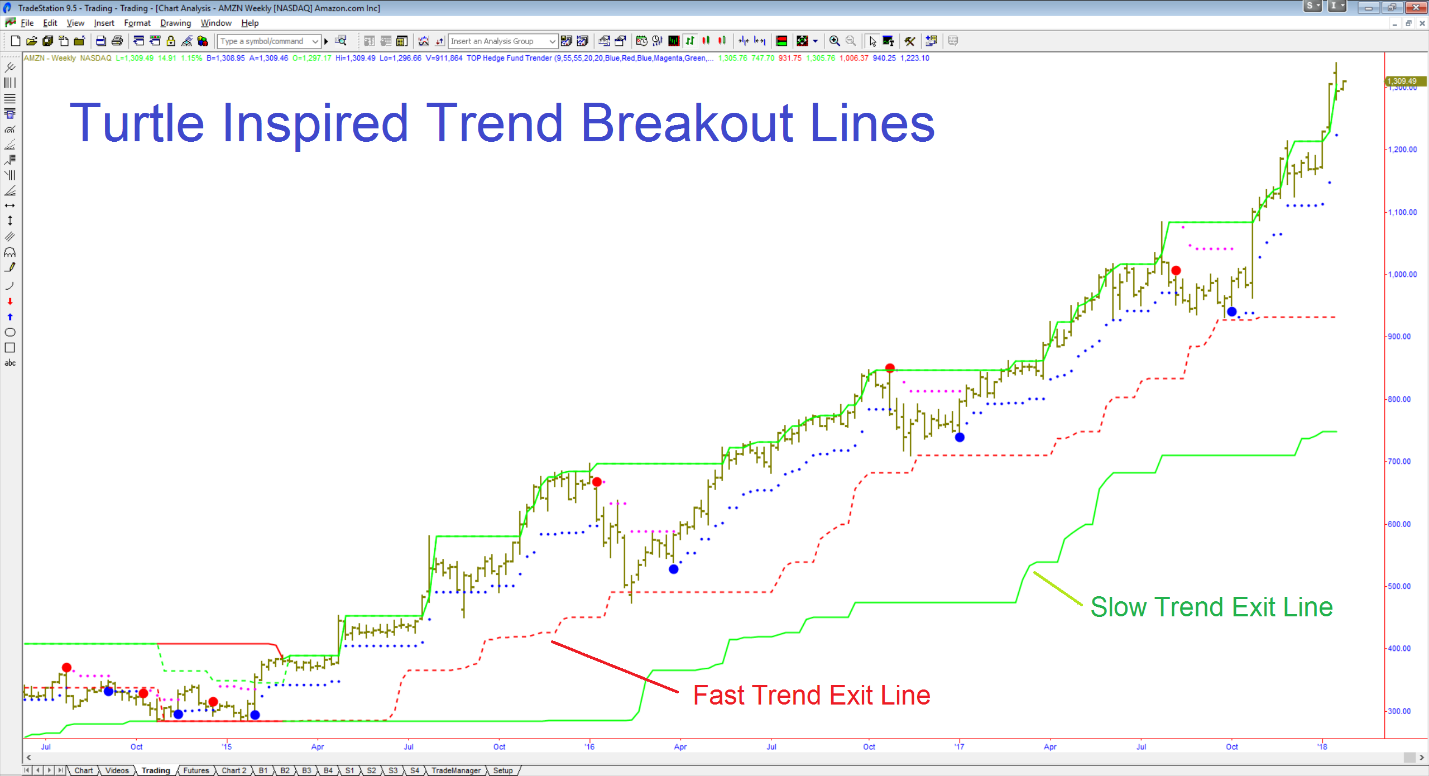

Turtle Trader Inspired Trend Breakout Lines

The Hedge Fund Trender also has Turtle Trader inspired trend breakout lines. So if you take a buy signal and think that a larger trend is underway, then you can use these powerful trend breakout lines to manage your trade in the direction of the trend.

What Should You Expect?

When you are trading, should you expect Hedge Fund Trender to make money on every trade? No. As with any trading strategy, there will be losing trades as you trade over time. No trading strategy in the world can guarantee winning results on every trading signal. However, the Hedge Fund Trender can generate exceptional trade entry and exit signals in markets that are experiencing significant swing price action or significant directional trending characteristics. By learning some simple, effective high probability trade setups in the markets, we believe any trader can further enhance Hedge Fund Trender profitability. Similar to every trading strategy, the Hedge Fund Trender results can be further improved when used in conjunction with a comprehensive approach to trading. But if you just want to use Hedge Fund Trender by itself, you can. If you want to learn how to enhance Hedge Fund Trender performance, we’ll show you exactly how we like to use the Hedge Fund Trender to trade (below).Real World Trading

You to be realistic about trading. Trading involves a high level of risk and there is no guarantee that you will make a million dollars this year by using the Hedge Fund Trender. However, as we all know, some people crack the code of the markets and make huge sums of money. There are no shortcuts. Successful traders do well through hard work and a consistent, disciplined approach to trading. And, most importantly, they have the right trading tools to give them an trading edge. Are you guaranteed to make money on every trade with Hedge Fund Trender? No. Can you use Hedge Fund Trender strategically with proven trade setups to make money in the markets? We feel that the answer to this question is a confident yes! But you need to put the time in to learn proven trade setups. This is not hard, but it does take time. The Hedge Fund Trender is based off of system technology that we used with our hedge fund to make money managing real customer accounts. But make no mistake, it took discipline and hard work. We believe that anyone can become a winning trader if they are willing to work hard and put in the time. The Hedge Fund Trender was developed to be a powerful addition to any trader’s toolbox.How We Trade with Hedge Fund Trender

When trading the markets, the goal of trading is to maximize the odds for success in your favor. This can be done in a number of ways, but one of the most powerful ways that we like to trade and put the odds in our favor is to use the Hedge Fund Trender buy or sell signals in the direction of a high probability trade setup. A high probability trade setup is like a reliable chart pattern that can be used to forecast where prices are likely to go. We believe that traders should only trade in favorable market conditions. We do not recommend trading Hedge Fund Trender in every market condition. Some market conditions are choppy and directionless. We recommend that you sit out during these market conditions as price movement tends to be random and choppy (see red box in chart below).

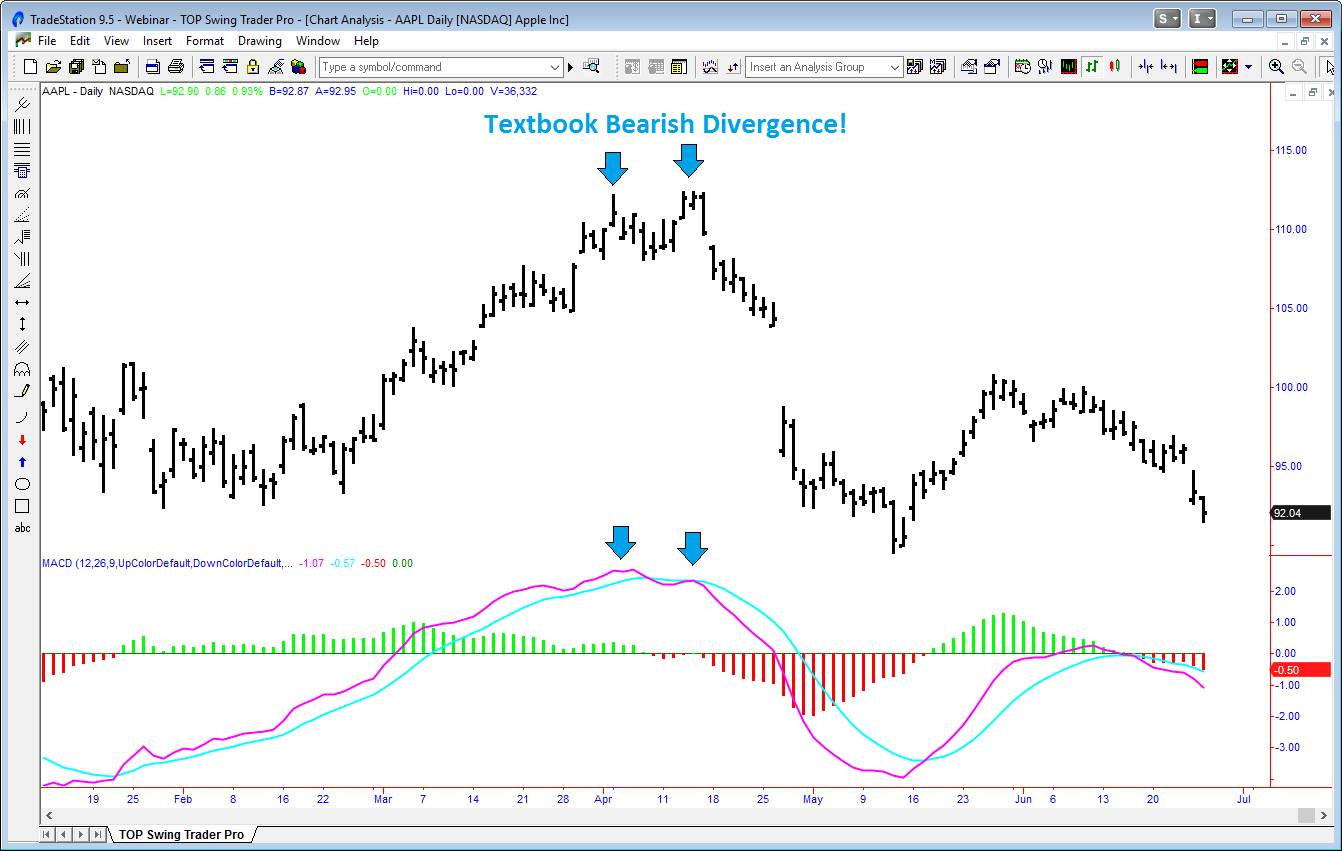

Apple (AAPL) Short Trading Example

Step one is to spot the daily bearish divergence. Then you could have taken sell signals from the Hedge Fund Trender on a shorter timeframe, like 60 minute charts.

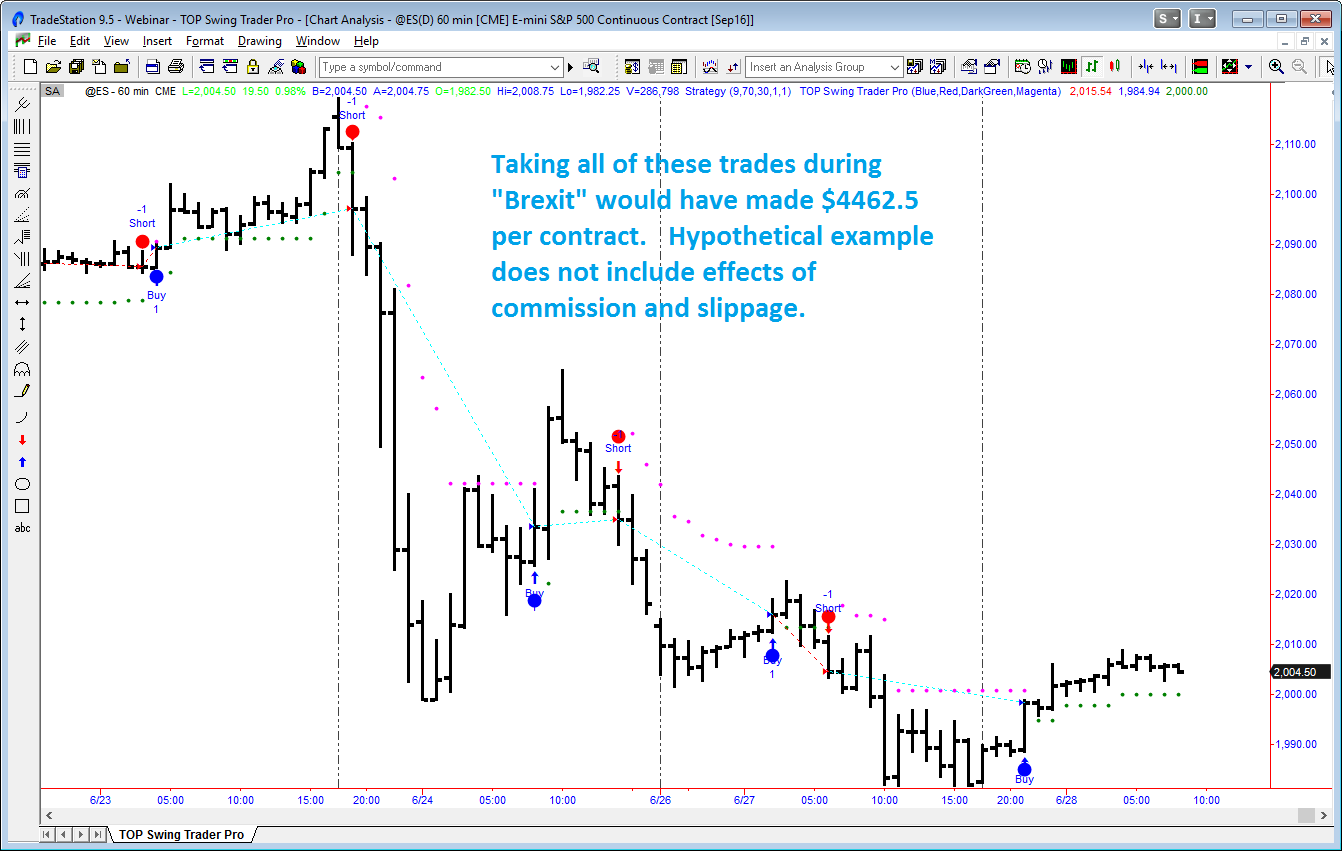

S&P 500 Futures (ES) “Brexit” Trading Example

Everyone knew that there would be tremendous volatility in the stock market during the Brexit vote when the UK was voting on whether to leave the EU. Events like this are often excellent opportunities to make great money off of the high volatility environment.

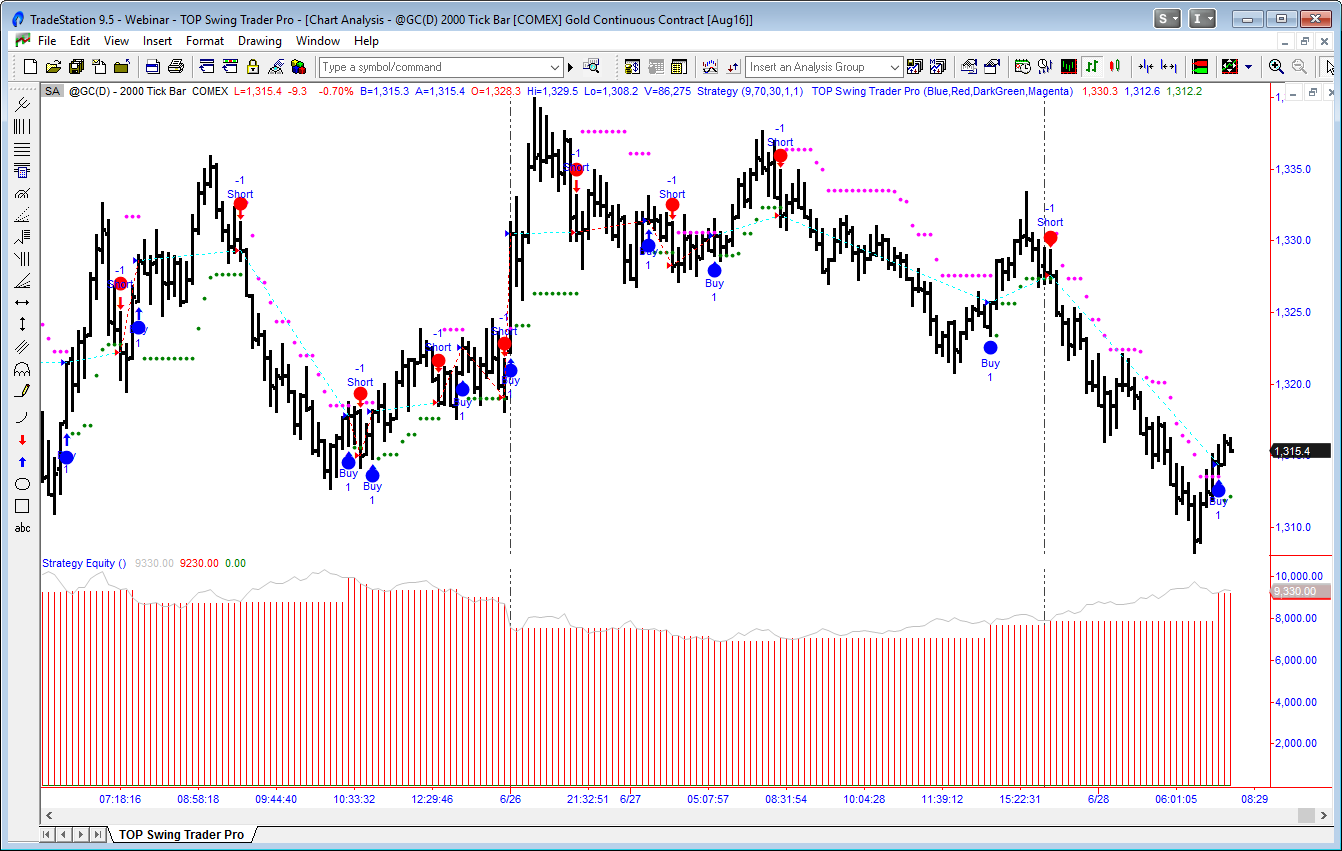

Gold Futures (GC) “Brexit” Trading Example

Again, everyone knew that there would be tremendous volatility in the stock market and in gold during the Brexit vote when the UK was voting on whether to leave the EU. Events like this are often excellent opportunities to make great money off of the high volatility conditions. We could have also considered trading Gold futures around the Brexit event.